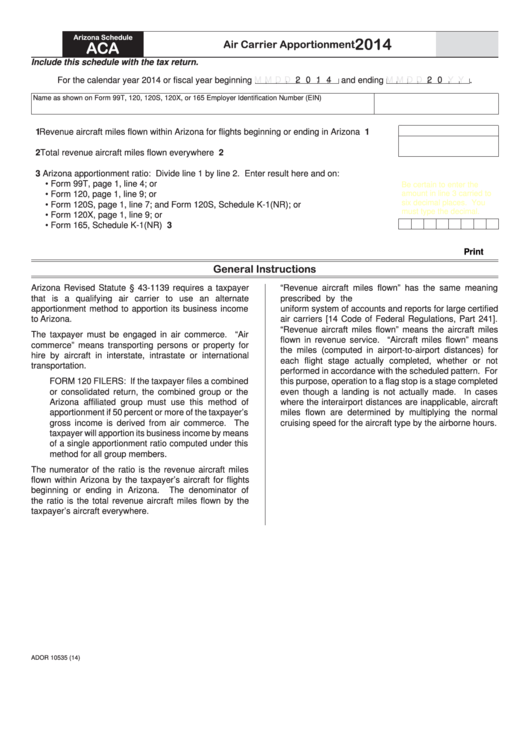

Arizona Schedule

2014

Air Carrier Apportionment

ACA

Include this schedule with the tax return.

M M D D

2 0 1 4 and ending

M M D D

2 0

Y Y

For the calendar year 2014 or fiscal year beginning

.

Name as shown on Form 99T, 120, 120S, 120X, or 165

Employer Identification Number (EIN)

1 Revenue aircraft miles flown within Arizona for flights beginning or ending in Arizona ......

1

2 Total revenue aircraft miles flown everywhere ...................................................................

2

3 Arizona apportionment ratio: Divide line 1 by line 2. Enter result here and on:

• Form 99T, page 1, line 4; or

Be certain to enter the

amount in line 3 carried to

• Form 120, page 1, line 9; or

six decimal places. You

• Form 120S, page 1, line 7; and Form 120S, Schedule K-1(NR); or

must type the decimal.

• Form 120X, page 1, line 9; or

• Form 165, Schedule K-1(NR) ..........................................................................................

3

Print

General Instructions

Arizona Revised Statute § 43-1139 requires a taxpayer

“Revenue aircraft miles flown” has the same meaning

that is a qualifying air carrier to use an alternate

prescribed by the U.S. Department of Transportation

apportionment method to apportion its business income

uniform system of accounts and reports for large certified

to Arizona.

air carriers [14 Code of Federal Regulations, Part 241].

“Revenue aircraft miles flown” means the aircraft miles

The taxpayer must be engaged in air commerce. “Air

flown in revenue service. “Aircraft miles flown” means

commerce” means transporting persons or property for

the miles (computed in airport-to-airport distances) for

hire by aircraft in interstate, intrastate or international

each flight stage actually completed, whether or not

transportation.

performed in accordance with the scheduled pattern. For

FORM 120 FILERS: If the taxpayer files a combined

this purpose, operation to a flag stop is a stage completed

or consolidated return, the combined group or the

even though a landing is not actually made. In cases

Arizona affiliated group must use this method of

where the interairport distances are inapplicable, aircraft

apportionment if 50 percent or more of the taxpayer’s

miles flown are determined by multiplying the normal

gross income is derived from air commerce. The

cruising speed for the aircraft type by the airborne hours.

taxpayer will apportion its business income by means

of a single apportionment ratio computed under this

method for all group members.

The numerator of the ratio is the revenue aircraft miles

flown within Arizona by the taxpayer’s aircraft for flights

beginning or ending in Arizona.

The denominator of

the ratio is the total revenue aircraft miles flown by the

taxpayer’s aircraft everywhere.

ADOR 10535 (14)

1

1