Dor Form 82061-B - Property Tax Form - Mines (Other Than Copper) - 2014

ADVERTISEMENT

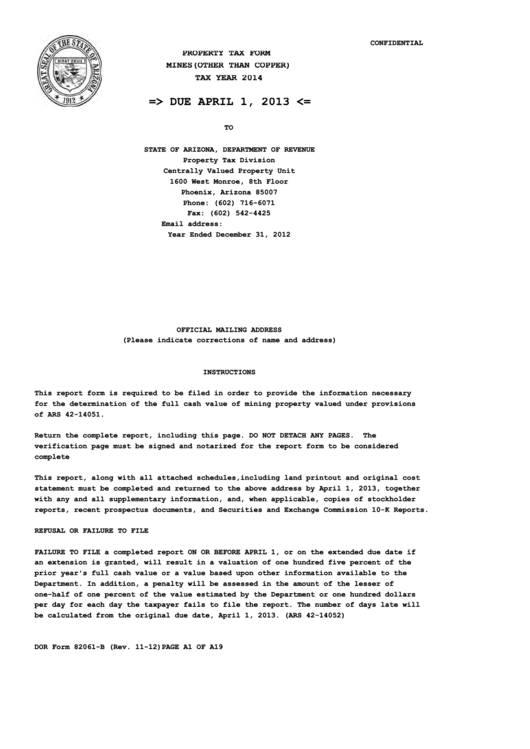

CONFIDENTIAL

PROPERTY TAX FORM

MINES(OTHER THAN COPPER)

TAX YEAR 2014

=> DUE APRIL 1, 2013 <=

TO

STATE OF ARIZONA, DEPARTMENT OF REVENUE

Property Tax Division

Centrally Valued Property Unit

1600 West Monroe, 8th Floor

Phoenix, Arizona 85007

Phone: (602) 716-6071

Fax: (602) 542-4425

Email address: vfagan@azdor.gov

Year Ended December 31, 2012

OFFICIAL MAILING ADDRESS

(Please indicate corrections of name and address)

INSTRUCTIONS

This report form is required to be filed in order to provide the information necessary

for the determination of the full cash value of mining property valued under provisions

of ARS 42-14051.

Return the complete report, including this page. DO NOT DETACH ANY PAGES.

The

verification page must be signed and notarized for the report form to be considered

complete

This report, along with all attached schedules,including land printout and original cost

statement must be completed and returned to the above address by April 1, 2013, together

with any and all supplementary information, and, when applicable, copies of stockholder

reports, recent prospectus documents, and Securities and Exchange Commission 10-K Reports.

REFUSAL OR FAILURE TO FILE

FAILURE TO FILE a completed report ON OR BEFORE APRIL 1, or on the extended due date if

an extension is granted, will result in a valuation of one hundred five percent of the

prior year's full cash value or a value based upon other information available to the

Department. In addition, a penalty will be assessed in the amount of the lesser of

one-half of one percent of the value estimated by the Department or one hundred dollars

per day for each day the taxpayer fails to file the report. The number of days late will

be calculated from the original due date, April 1, 2013. (ARS 42-14052)

DOR Form 82061-B (Rev. 11-12)

PAGE A1 OF A19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19