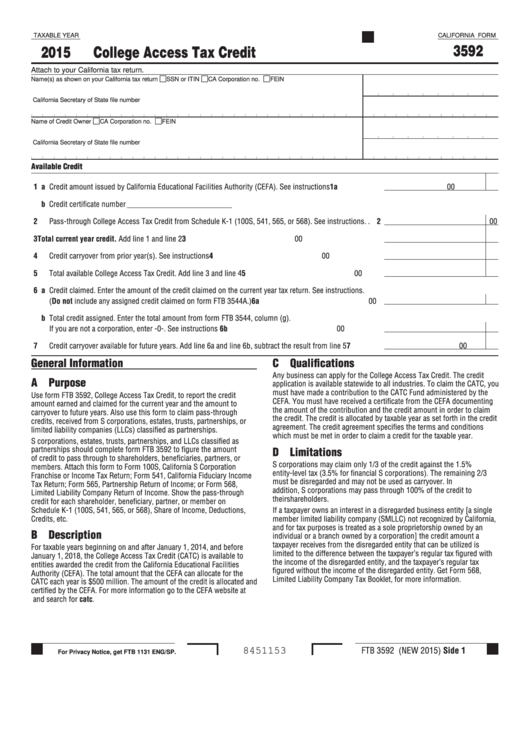

TAXABLE YEAR

CALIFORNIA FORM

3592

2015

College Access Tax Credit

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

California Secretary of State file number

Name of Credit Owner

CA Corporation no.

FEIN

California Secretary of State file number

Available Credit

1 a Credit amount issued by California Educational Facilities Authority (CEFA). See instructions . . . . . . . . . . . 1a

00

b Credit certificate number

2

Pass-through College Access Tax Credit from Schedule K-1 (100S, 541, 565, or 568). See instructions. . 2

00

3

Total current year credit. Add line 1 and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4

Credit carryover from prior year(s). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5

Total available College Access Tax Credit. Add line 3 and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 a Credit claimed. Enter the amount of the credit claimed on the current year tax return. See instructions.

(Do not include any assigned credit claimed on form FTB 3544A.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

00

b Total credit assigned. Enter the total amount from form FTB 3544, column (g).

If you are not a corporation, enter -0-. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

00

7

Credit carryover available for future years. Add line 6a and line 6b, subtract the result from line 5 . . . . . . 7

00

General Information

C Qualifications

Any business can apply for the College Access Tax Credit. The credit

A Purpose

application is available statewide to all industries. To claim the CATC, you

must have made a contribution to the CATC Fund administered by the

Use form FTB 3592, College Access Tax Credit, to report the credit

CEFA. You must have received a certificate from the CEFA documenting

amount earned and claimed for the current year and the amount to

the amount of the contribution and the credit amount in order to claim

carryover to future years. Also use this form to claim pass-through

the credit. The credit is allocated by taxable year as set forth in the credit

credits, received from S corporations, estates, trusts, partnerships, or

agreement. The credit agreement specifies the terms and conditions

limited liability companies (LLCs) classified as partnerships.

which must be met in order to claim a credit for the taxable year.

S corporations, estates, trusts, partnerships, and LLCs classified as

partnerships should complete form FTB 3592 to figure the amount

D Limitations

of credit to pass through to shareholders, beneficiaries, partners, or

S corporations may claim only 1/3 of the credit against the 1.5%

members. Attach this form to Form 100S, California S Corporation

entity-level tax (3.5% for financial S corporations). The remaining 2/3

Franchise or Income Tax Return; Form 541, California Fiduciary Income

must be disregarded and may not be used as carryover. In

Tax Return; Form 565, Partnership Return of Income; or Form 568,

addition, S corporations may pass through 100% of the credit to

Limited Liability Company Return of Income. Show the pass-through

their shareholders.

credit for each shareholder, beneficiary, partner, or member on

Schedule K-1 (100S, 541, 565, or 568), Share of Income, Deductions,

If a taxpayer owns an interest in a disregarded business entity [a single

Credits, etc.

member limited liability company (SMLLC) not recognized by California,

and for tax purposes is treated as a sole proprietorship owned by an

B Description

individual or a branch owned by a corporation] the credit amount a

taxpayer receives from the disregarded entity that can be utilized is

For taxable years beginning on and after January 1, 2014, and before

limited to the difference between the taxpayer’s regular tax figured with

January 1, 2018, the College Access Tax Credit (CATC) is available to

the income of the disregarded entity, and the taxpayer’s regular tax

entities awarded the credit from the California Educational Facilities

figured without the income of the disregarded entity. Get Form 568,

Authority (CEFA). The total amount that the CEFA can allocate for the

Limited Liability Company Tax Booklet, for more information.

CATC each year is $500 million. The amount of the credit is allocated and

certified by the CEFA. For more information go to the CEFA website at

treasurer.ca.gov and search for catc.

FTB 3592 (NEW 2015) Side 1

8451153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2