Instructions For Arizona Form 140x - 2013

ADVERTISEMENT

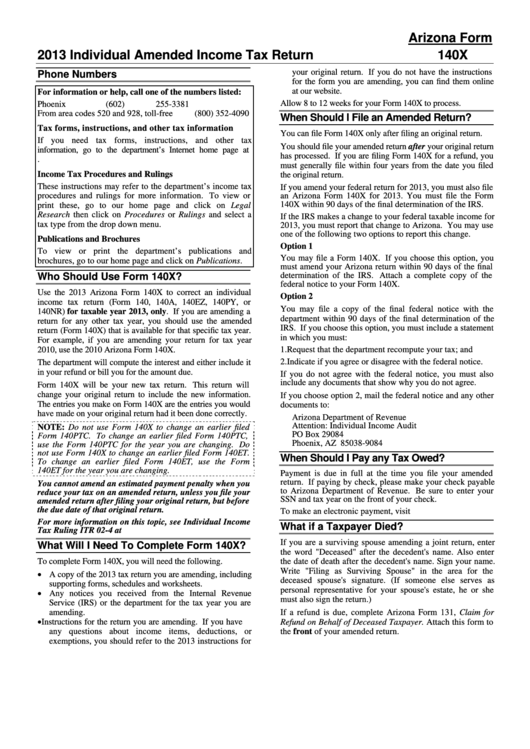

Arizona Form

2013 Individual Amended Income Tax Return

140X

your original return. If you do not have the instructions

Phone Numbers

for the form you are amending, you can find them online

at our website.

For information or help, call one of the numbers listed:

Allow 8 to 12 weeks for your Form 140X to process.

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

When Should I File an Amended Return?

Tax forms, instructions, and other tax information

You can file Form 140X only after filing an original return.

If you need tax forms, instructions, and other tax

You should file your amended return after your original return

information, go to the department’s Internet home page at

has processed. If you are filing Form 140X for a refund, you

must generally file within four years from the date you filed

Income Tax Procedures and Rulings

the original return.

These instructions may refer to the department’s income tax

If you amend your federal return for 2013, you must also file

procedures and rulings for more information. To view or

an Arizona Form 140X for 2013. You must file the Form

140X within 90 days of the final determination of the IRS.

print these, go to our home page and click on Legal

Research then click on Procedures or Rulings and select a

If the IRS makes a change to your federal taxable income for

tax type from the drop down menu.

2013, you must report that change to Arizona. You may use

one of the following two options to report this change.

Publications and Brochures

Option 1

To view or print the department’s publications and

You may file a Form 140X. If you choose this option, you

brochures, go to our home page and click on Publications.

must amend your Arizona return within 90 days of the final

Who Should Use Form 140X?

determination of the IRS. Attach a complete copy of the

federal notice to your Form 140X.

Use the 2013 Arizona Form 140X to correct an individual

Option 2

income tax return (Form 140, 140A, 140EZ, 140PY, or

You may file a copy of the final federal notice with the

140NR) for taxable year 2013, only. If you are amending a

department within 90 days of the final determination of the

return for any other tax year, you should use the amended

IRS. If you choose this option, you must include a statement

return (Form 140X) that is available for that specific tax year.

in which you must:

For example, if you are amending your return for tax year

2010, use the 2010 Arizona Form 140X.

1. Request that the department recompute your tax; and

2. Indicate if you agree or disagree with the federal notice.

The department will compute the interest and either include it

in your refund or bill you for the amount due.

If you do not agree with the federal notice, you must also

include any documents that show why you do not agree.

Form 140X will be your new tax return. This return will

change your original return to include the new information.

If you choose option 2, mail the federal notice and any other

The entries you make on Form 140X are the entries you would

documents to:

have made on your original return had it been done correctly.

Arizona Department of Revenue

Attention: Individual Income Audit

NOTE: Do not use Form 140X to change an earlier filed

PO Box 29084

Form 140PTC. To change an earlier filed Form 140PTC,

Phoenix, AZ 85038-9084

use the Form 140PTC for the year you are changing. Do

not use Form 140X to change an earlier filed Form 140ET.

When Should I Pay any Tax Owed?

To change an earlier filed Form 140ET, use the Form

140ET for the year you are changing.

Payment is due in full at the time you file your amended

return. If paying by check, please make your check payable

You cannot amend an estimated payment penalty when you

to Arizona Department of Revenue. Be sure to enter your

reduce your tax on an amended return, unless you file your

SSN and tax year on the front of your check.

amended return after filing your original return, but before

the due date of that original return.

To make an electronic payment, visit

For more information on this topic, see Individual Income

What if a Taxpayer Died?

Tax Ruling ITR 02-4 at

If you are a surviving spouse amending a joint return, enter

What Will I Need To Complete Form 140X?

the word "Deceased" after the decedent's name. Also enter

To complete Form 140X, you will need the following.

the date of death after the decedent's name. Sign your name.

Write "Filing as Surviving Spouse" in the area for the

A copy of the 2013 tax return you are amending, including

deceased spouse's signature. (If someone else serves as

supporting forms, schedules and worksheets.

personal representative for your spouse's estate, he or she

Any notices you received from the Internal Revenue

must also sign the return.)

Service (IRS) or the department for the tax year you are

amending.

If a refund is due, complete Arizona Form 131, Claim for

Instructions for the return you are amending. If you have

Refund on Behalf of Deceased Taxpayer. Attach this form to

any questions about income items, deductions, or

the front of your amended return.

exemptions, you should refer to the 2013 instructions for

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10