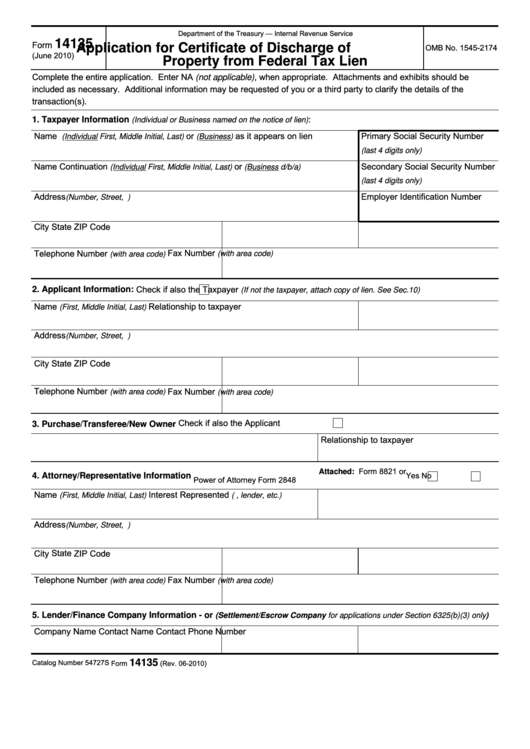

Department of the Treasury — Internal Revenue Service

14135

Form

Application for Certificate of Discharge of

OMB No. 1545-2174

(June 2010)

Property from Federal Tax Lien

Complete the entire application. Enter NA (not applicable), when appropriate. Attachments and exhibits should be

included as necessary. Additional information may be requested of you or a third party to clarify the details of the

transaction(s).

:

1. Taxpayer Information

(Individual or Business named on the notice of lien)

Name

or

as it appears on lien

Primary Social Security Number

(Individual First, Middle Initial, Last)

(Business)

(last 4 digits only)

Name Continuation

or

Secondary Social Security Number

(Individual First, Middle Initial, Last)

(Business d/b/a)

(last 4 digits only)

Address

Employer Identification Number

(Number, Street, P.O. Box)

City

State

ZIP Code

Fax Number

Telephone Number

(with area code)

(with area code)

Check if also the Taxpayer

2. Applicant Information:

(If not the taxpayer, attach copy of lien. See Sec.10)

Name

Relationship to taxpayer

(First, Middle Initial, Last)

Address

(Number, Street, P.O. Box)

City

State

ZIP Code

Telephone Number

Fax Number

(with area code)

(with area code)

Check if also the Applicant

3. Purchase/Transferee/New Owner

Relationship to taxpayer

Attached: Form 8821 or

Yes

No

4. Attorney/Representative Information

Power of Attorney Form 2848

Name

Interest Represented

(First, Middle Initial, Last)

(e.g. taxpayer, lender, etc.)

Address

(Number, Street, P.O. Box)

State

City

ZIP Code

Telephone Number

Fax Number

(with area code)

(with area code)

5. Lender/Finance Company Information - or

(Settlement/Escrow Company for applications under Section 6325(b)(3) only)

Company Name

Contact Name

Contact Phone Number

Catalog Number 54727S

Form

14135

(Rev. 06-2010)

1

1 2

2 3

3