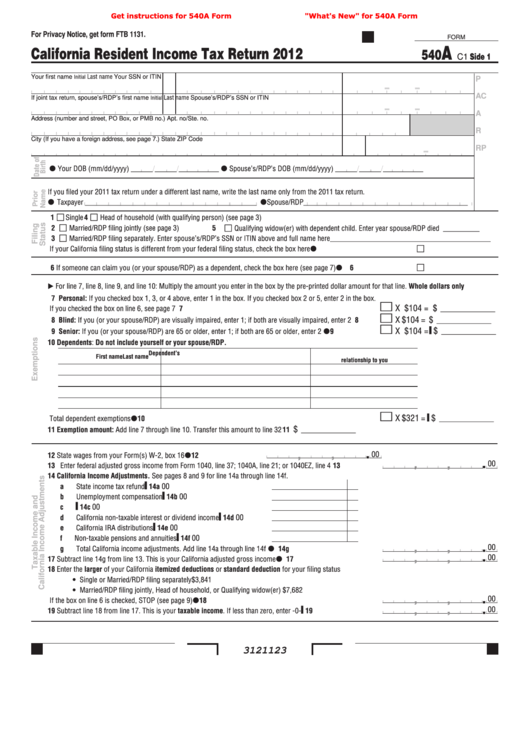

Get instructions for 540A Form

"What's New" for 540A Form

For Privacy Notice, get form FTB 1131.

FORM

A

California Resident Income Tax Return 2012

540

C1 Side 1

Last name

Initial

Your first name

Your SSN or ITIN

P

AC

Last name

Initial

If joint tax return, spouse’s/RDP’s first name

Spouse’s/RDP’s SSN or ITIN

A

Address (number and street, PO Box, or PMB no.)

Apt. no/Ste. no.

R

City (If you have a foreign address, see page 7.)

State

ZIP Code

RP

Your DOB (mm/dd/yyyy) ______/______/___________

Spouse’s/RDP’s DOB (mm/dd/yyyy) ______/______/___________

If you filed your 2011 tax return under a different last name, write the last name only from the 2011 tax return .

Taxpayer _______________________________________________

Spouse/RDP_____________________________________________

1

Single

4

Head of household (with qualifying person) (see page 3)

2

Married/RDP filing jointly (see page 3)

5

Qualifying widow(er) with dependent child . Enter year spouse/RDP died __________

3

Married/RDP filing separately . Enter spouse’s/RDP’s SSN or ITIN above and full name here____________________________________________

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . . . . . . . . . . . .

6

If someone can claim you (or your spouse/RDP) as a dependent, check the box here (see page 7) . . . . . . . . . . . . . .

6

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the pre-printed dollar amount for that line .

Whole dollars only

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box . If you checked box 2 or 5, enter 2 in the box .

X $104 = $

If you checked the box on line 6, see page 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

_______________

X $104 = $

8 Blind: If you (or your spouse/RDP) are visually impaired, enter 1; if both are visually impaired, enter 2 . . . . 8

_______________

▌

X $104 =

$

9 Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . . . . . . . .

9

_______________

10 Dependents: Do not include yourself or your spouse/RDP.

Dependent’s

First name

Last name

relationship to you

▌

X $321 =

$

Total dependent exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

_______________

$

11 Exemption amount: Add line 7 through line 10 . Transfer this amount to line 32 . . . . . . . . . . . . . . . . . . . . 11

_______________

.

00

,

,

12 State wages from your Form(s) W-2, box 16 . . . . . . . . . . . . . . .

12

.

00

,

,

13 Enter federal adjusted gross income from Form 1040, line 37; 1040A, line 21; or 1040EZ, line 4 . . . . . . . . . . . 13

14 California Income Adjustments. See pages 8 and 9 for line 14a through line 14f .

▌

00

a State income tax refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14a

▌

00

b Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . .

14b

▌

00

c U .S . social security or railroad retirement . . . . . . . . . . . . . . . . .

14c

▌

00

d California non-taxable interest or dividend income . . . . . . . . . . .

14d

▌

00

e California IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14e

▌

00

f Non-taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . .

14f

.

00

,

,

g Total California income adjustments . Add line 14a through line 14f . . . . . . . . . . . . . . . . . . . . . . . . . . .

14g

.

00

,

,

17 Subtract line 14g from line 13 . This is your California adjusted gross income . . . . . . . . . . . . . . . . . . . . . .

17

18 Enter the larger of your California itemized deductions or standard deduction for your filing status

• Single or Married/RDP filing separately . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,841

• Married/RDP filing jointly, Head of household, or Qualifying widow(er) . . . . . . . . . . . $7,682

.

00

,

,

If the box on line 6 is checked, STOP (see page 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

.

00

▌

,

,

19 Subtract line 18 from line 17 . This is your taxable income . If less than zero, enter -0- . . . . . . . . . . . . . . .

19

3121123

1

1 2

2 3

3