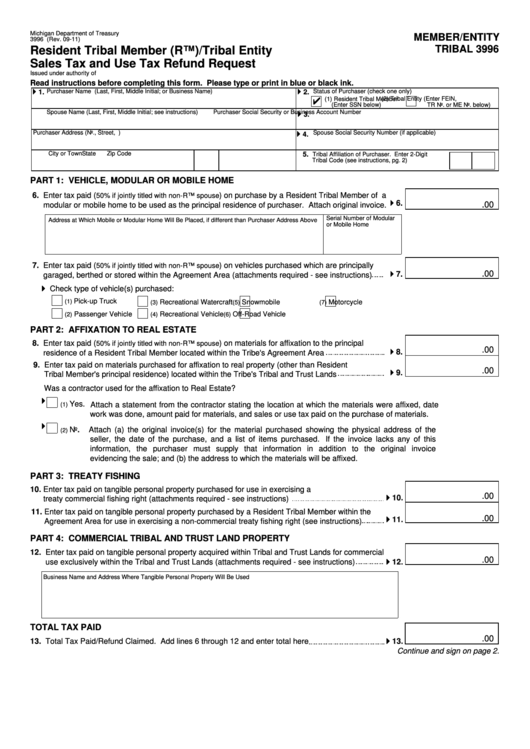

Michigan Department of Treasury

MEMBER/ENTITY

3996 (Rev. 09-11)

TRIBAL 3996

Resident Tribal Member (RTM)/Tribal Entity

Sales Tax and Use Tax Refund Request

Issued under authority of P.A. 616 of 2002.

Read instructions before completing this form. Please type or print in blue or black ink.

Purchaser Name (Last, First, Middle Initial; or Business Name)

Status of Purchaser (check one only)

1.

2.

(1) Resident Tribal Member

(2) Tribal Entity (Enter FEIN,

(Enter SSN below)

TR No. or ME No. below)

Spouse Name (Last, First, Middle Initial; see instructions)

Purchaser Social Security or Business Account Number

3.

Purchaser Address (No., Street, P.O. Box or Rural Route)

Spouse Social Security Number (if applicable)

4.

City or Town

State

Zip Code

5.

Tribal Affiliation of Purchaser. Enter 2-Digit

Tribal Code (see instructions, pg. 2)

PART 1: VEHICLE, MODULAR OR MOBILE HOME

6. Enter tax paid (

) on purchase by a Resident Tribal Member of a

50% if jointly titled with non-RTM spouse

6.

.00

modular or mobile home to be used as the principal residence of purchaser. Attach original invoice.

Serial Number of Modular

Address at Which Mobile or Modular Home Will Be Placed, if different than Purchaser Address Above

or Mobile Home

7. Enter tax paid (

) on vehicles purchased which are principally

50% if jointly titled with non-RTM spouse

.00

7.

garaged, berthed or stored within the Agreement Area (attachments required - see instructions)

Check type of vehicle(s) purchased:

Pick-up Truck

(1)

Recreational Watercraft

Snowmobile

Motorcycle

(3)

(5)

(7)

Passenger Vehicle

Recreational Vehicle

Off-Road Vehicle

(2)

(4)

(6)

PART 2: AFFIXATION TO REAL ESTATE

8. Enter tax paid (

) on materials for affixation to the principal

50% if jointly titled with non-RTM spouse

.00

8.

residence of a Resident Tribal Member located within the Tribe's Agreement Area

9. Enter tax paid on materials purchased for affixation to real property (other than Resident

.00

9.

Tribal Member's principal residence) located within the Tribe's Tribal and Trust Lands

Was a contractor used for the affixation to Real Estate?

Yes. Attach a statement from the contractor stating the location at which the materials were affixed, date

(1)

work was done, amount paid for materials, and sales or use tax paid on the purchase of materials.

No.

Attach (a) the original invoice(s) for the material purchased showing the physical address of the

(2)

seller, the date of the purchase, and a list of items purchased. If the invoice lacks any of this

information, the purchaser must supply that information in addition to the original invoice

evidencing the sale; and (b) the address to which the materials will be affixed.

PART 3: TREATY FISHING

10. Enter tax paid on tangible personal property purchased for use in exercising a

.00

10.

treaty commercial fishing right (attachments required - see instructions)

11. Enter tax paid on tangible personal property purchased by a Resident Tribal Member within the

.00

11.

Agreement Area for use in exercising a non-commercial treaty fishing right (see instructions)

PART 4: COMMERCIAL TRIBAL AND TRUST LAND PROPERTY

12. Enter tax paid on tangible personal property acquired within Tribal and Trust Lands for commercial

.00

use exclusively within the Tribal and Trust Lands (attachments required - see instructions)

12.

Business Name and Address Where Tangible Personal Property Will Be Used

TOTAL TAX PAID

.00

13. Total Tax Paid/Refund Claimed. Add lines 6 through 12 and enter total here

13.

Continue and sign on page 2.

1

1 2

2