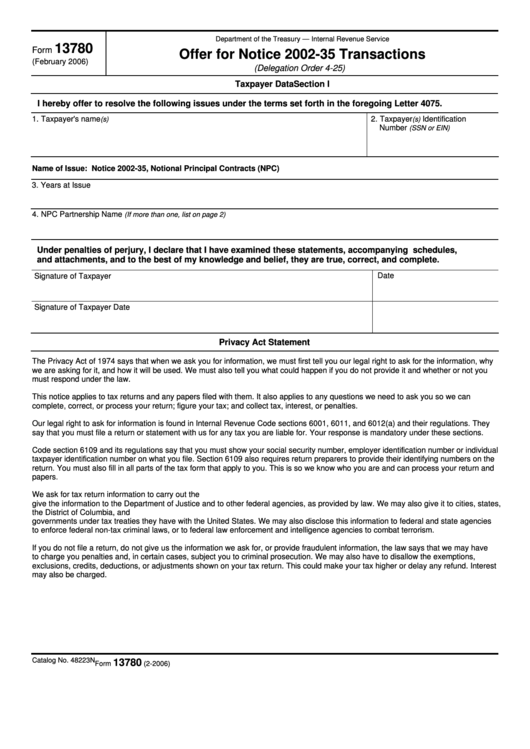

Department of the Treasury — Internal Revenue Service

13780

Form

Offer for Notice 2002-35 Transactions

(February 2006)

(Delegation Order 4-25)

Section I

Taxpayer Data

I hereby offer to resolve the following issues under the terms set forth in the foregoing Letter 4075.

1. Taxpayer's name

2. Taxpayer

Identification

(s)

(s)

Number

(SSN or EIN)

Name of Issue: Notice 2002-35, Notional Principal Contracts (NPC)

3. Years at Issue

4. NPC Partnership Name

(If more than one, list on page 2)

Under penalties of perjury, I declare that I have examined these statements, accompanying schedules,

and attachments, and to the best of my knowledge and belief, they are true, correct, and complete.

Date

Signature of Taxpayer

Signature of Taxpayer

Date

Privacy Act Statement

The Privacy Act of 1974 says that when we ask you for information, we must first tell you our legal right to ask for the information, why

we are asking for it, and how it will be used. We must also tell you what could happen if you do not provide it and whether or not you

must respond under the law.

This notice applies to tax returns and any papers filed with them. It also applies to any questions we need to ask you so we can

complete, correct, or process your return; figure your tax; and collect tax, interest, or penalties.

Our legal right to ask for information is found in Internal Revenue Code sections 6001, 6011, and 6012(a) and their regulations. They

say that you must file a return or statement with us for any tax you are liable for. Your response is mandatory under these sections.

Code section 6109 and its regulations say that you must show your social security number, employer identification number or individual

taxpayer identification number on what you file. Section 6109 also requires return preparers to provide their identifying numbers on the

return. You must also fill in all parts of the tax form that apply to you. This is so we know who you are and can process your return and

papers.

We ask for tax return information to carry out the U.S. tax laws. We need it to figure and collect the right amount of tax. We may

give the information to the Department of Justice and to other federal agencies, as provided by law. We may also give it to cities, states,

the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. And we may give it to certain foreign

governments under tax treaties they have with the United States. We may also disclose this information to federal and state agencies

to enforce federal non-tax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

If you do not file a return, do not give us the information we ask for, or provide fraudulent information, the law says that we may have

to charge you penalties and, in certain cases, subject you to criminal prosecution. We may also have to disallow the exemptions,

exclusions, credits, deductions, or adjustments shown on your tax return. This could make your tax higher or delay any refund. Interest

may also be charged.

Catalog No. 48223N

13780

Page 1 of 2

Form

(2-2006)

1

1 2

2