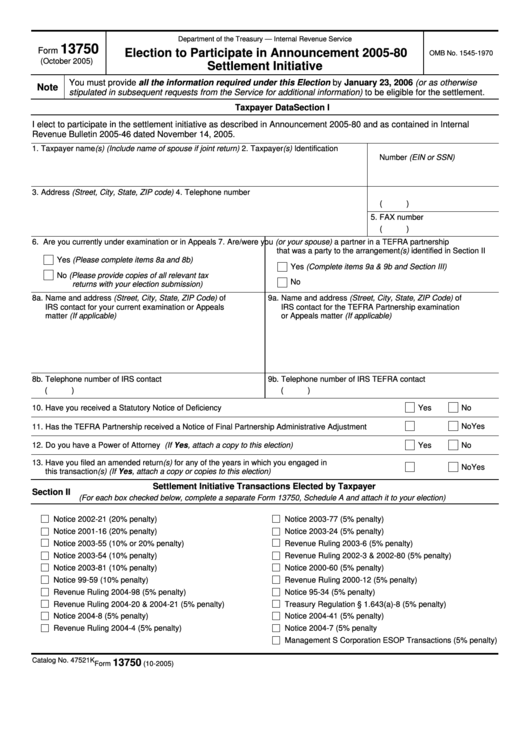

Department of the Treasury — Internal Revenue Service

13750

Form

Election to Participate in Announcement 2005-80

OMB No. 1545-1970

(October 2005)

Settlement Initiative

You must provide all the information required under this Election by January 23, 2006 (or as otherwise

Note

stipulated in subsequent requests from the Service for additional information) to be eligible for the settlement.

Section I

Taxpayer Data

I elect to participate in the settlement initiative as described in Announcement 2005-80 and as contained in Internal

Revenue Bulletin 2005-46 dated November 14, 2005.

1. Taxpayer name(s) (Include name of spouse if joint return)

2. Taxpayer(s) Identification

Number (EIN or SSN)

3. Address (Street, City, State, ZIP code)

4. Telephone number

(

)

5. FAX number

(

)

6. Are you currently under examination or in Appeals

7. Are/were you (or your spouse) a partner in a TEFRA partnership

that was a party to the arrangement(s) identified in Section II

Yes (Please complete items 8a and 8b)

Yes (Complete items 9a & 9b and Section III)

No (Please provide copies of all relevant tax

No

returns with your election submission)

8a. Name and address (Street, City, State, ZIP Code) of

9a. Name and address (Street, City, State, ZIP Code) of

IRS contact for your current examination or Appeals

IRS contact for the TEFRA Partnership examination

matter (If applicable)

or Appeals matter (If applicable)

8b. Telephone number of IRS contact

9b. Telephone number of IRS TEFRA contact

(

)

(

)

10. Have you received a Statutory Notice of Deficiency

Yes

No

Yes

No

11. Has the TEFRA Partnership received a Notice of Final Partnership Administrative Adjustment

12. Do you have a Power of Attorney (If Yes, attach a copy to this election)

Yes

No

13. Have you filed an amended return(s) for any of the years in which you engaged in

Yes

No

this transaction(s) (If Yes, attach a copy or copies to this election)

Settlement Initiative Transactions Elected by Taxpayer

Section II

(For each box checked below, complete a separate Form 13750, Schedule A and attach it to your election)

Notice 2002-21 (20% penalty)

Notice 2003-77 (5% penalty)

Notice 2001-16 (20% penalty)

Notice 2003-24 (5% penalty)

Notice 2003-55 (10% or 20% penalty)

Revenue Ruling 2003-6 (5% penalty)

Notice 2003-54 (10% penalty)

Revenue Ruling 2002-3 & 2002-80 (5% penalty)

Notice 2003-81 (10% penalty)

Notice 2000-60 (5% penalty)

Notice 99-59 (10% penalty)

Revenue Ruling 2000-12 (5% penalty)

Revenue Ruling 2004-98 (5% penalty)

Notice 95-34 (5% penalty)

Revenue Ruling 2004-20 & 2004-21 (5% penalty)

Treasury Regulation § 1.643(a)-8 (5% penalty)

Notice 2004-8 (5% penalty)

Notice 2004-41 (5% penalty)

Revenue Ruling 2004-4 (5% penalty)

Notice 2004-7 (5% penalty

Management S Corporation ESOP Transactions (5% penalty)

Catalog No. 47521K

13750

Form

(10-2005)

1

1 2

2 3

3 4

4