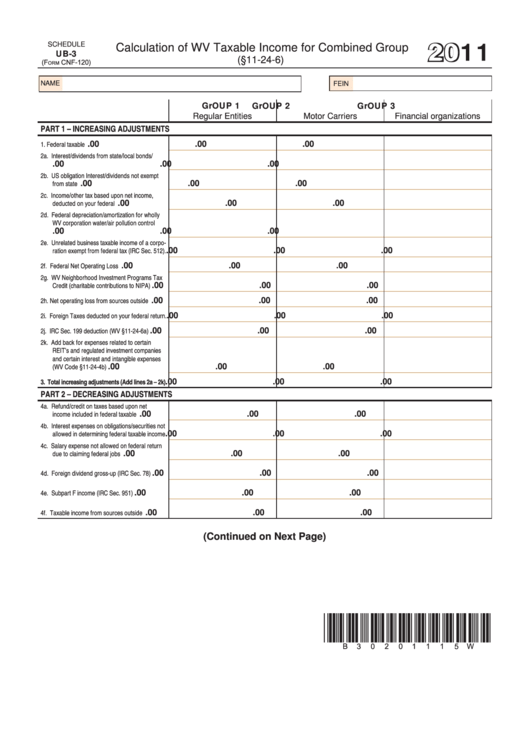

Schedule Ub-3 (Form Cnf-120) - Calculation Of Wv Taxable Income For Combined Group - 2011

ADVERTISEMENT

2011

SCHEduLE

Calculation of WV Taxable Income for Combined Group

UB-3

(§11-24-6)

CNF-120)

(F

orm

NaME

FEIN

GrOUP 1

GrOUP 2

GrOUP 3

Regular Entities

Motor Carriers

Financial organizations

PART 1 – InCREASInG ADjUSTmEnTS

1. Federal taxable income........................................

.00

.00

.00

2a. Interest/dividends from state/local bonds/

securities..........................................................

.00

.00

.00

2b. US obligation Interest/dividends not exempt

from state tax....................................................

.00

.00

.00

2c. Income/other tax based upon net income,

deducted on your federal return.......................

.00

.00

.00

2d. Federal depreciation/amortization for wholly

WV corporation water/air pollution control

facilities.............................................................

.00

.00

.00

2e. Unrelated business taxable income of a corpo-

ration exempt from federal tax (IRC Sec. 512).

.00

.00

.00

2f. Federal Net Operating Loss deduction..............

.00

.00

.00

2g. WV Neighborhood Investment Programs Tax

Credit (charitable contributions to NIPA)..........

.00

.00

.00

2h. Net operating loss from sources outside US.....

.00

.00

.00

2i. Foreign Taxes deducted on your federal return.

.00

.00

.00

2j. IRC Sec. 199 deduction (WV §11-24-6a)...........

.00

.00

.00

2k. Add back for expenses related to certain

REIT’s and regulated investment companies

and certain interest and intangible expenses

(WV Code §11-24-4b)......................................

.00

.00

.00

3. Total increasing adjustments (Add lines 2a – 2k)

.00

.00

.00

PART 2 – DECREASInG ADjUSTmEnTS

4a. Refund/credit on taxes based upon net

income included in federal taxable income......

.00

.00

.00

4b. Interest expenses on obligations/securities not

allowed in determining federal taxable income

.00

.00

.00

4c. Salary expense not allowed on federal return

due to claiming federal jobs credit....................

.00

.00

.00

4d. Foreign dividend gross-up (IRC Sec. 78).........

.00

.00

.00

4e. Subpart F income (IRC Sec. 951).....................

.00

.00

.00

4f. Taxable income from sources outside US..........

.00

.00

.00

(Continued on Next Page)

*B30201115W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2