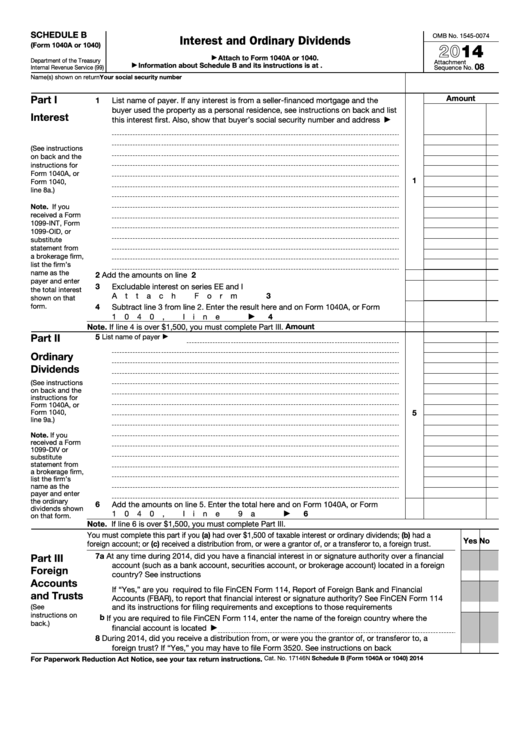

SCHEDULE B

OMB No. 1545-0074

Interest and Ordinary Dividends

2014

(Form 1040A or 1040)

Attach to Form 1040A or 1040.

▶

Department of the Treasury

Attachment

Information about Schedule B and its instructions is at

08

▶

Internal Revenue Service (99)

Sequence No.

Name(s) shown on return

Your social security number

Part I

Amount

1

List name of payer. If any interest is from a seller-financed mortgage and the

buyer used the property as a personal residence, see instructions on back and list

Interest

this interest first. Also, show that buyer’s social security number and address

▶

(See instructions

on back and the

instructions for

Form 1040A, or

1

Form 1040,

line 8a.)

Note. If you

received a Form

1099-INT, Form

1099-OID, or

substitute

statement from

a brokerage firm,

list the firm’s

name as the

2

Add the amounts on line 1 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

payer and enter

3

Excludable interest on series EE and I U.S. savings bonds issued after 1989.

the total interest

3

Attach Form 8815 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

shown on that

form.

4

Subtract line 3 from line 2. Enter the result here and on Form 1040A, or Form

4

1040, line 8a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Amount

Note. If line 4 is over $1,500, you must complete Part III.

Part II

5

List name of payer

▶

Ordinary

Dividends

(See instructions

on back and the

instructions for

Form 1040A, or

Form 1040,

5

line 9a.)

Note. If you

received a Form

1099-DIV or

substitute

statement from

a brokerage firm,

list the firm’s

name as the

payer and enter

the ordinary

6

Add the amounts on line 5. Enter the total here and on Form 1040A, or Form

dividends shown

1040, line 9a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

▶

on that form.

Note. If line 6 is over $1,500, you must complete Part III.

You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a

Yes No

foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign trust.

7a At any time during 2014, did you have a financial interest in or signature authority over a financial

Part III

account (such as a bank account, securities account, or brokerage account) located in a foreign

Foreign

country? See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Accounts

If “Yes,” are you required to file FinCEN Form 114, Report of Foreign Bank and Financial

and Trusts

Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114

and its instructions for filing requirements and exceptions to those requirements .

.

.

.

.

.

(See

instructions on

b If you are required to file FinCEN Form 114, enter the name of the foreign country where the

back.)

financial account is located

▶

8

During 2014, did you receive a distribution from, or were you the grantor of, or transferor to, a

foreign trust? If “Yes,” you may have to file Form 3520. See instructions on back .

.

.

.

.

.

Cat. No. 17146N

Schedule B (Form 1040A or 1040) 2014

For Paperwork Reduction Act Notice, see your tax return instructions.

1

1 2

2