Reset Form

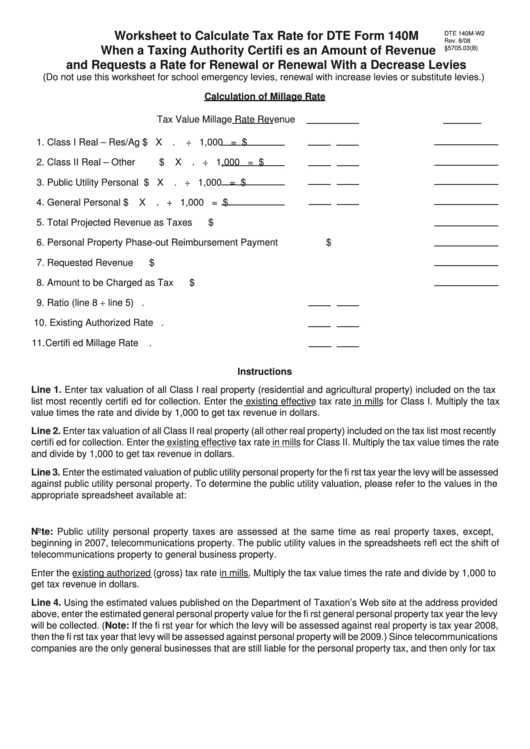

Worksheet to Calculate Tax Rate for DTE Form 140M

DTE 140M-W2

Rev. 8/08

When a Taxing Authority Certifi es an Amount of Revenue

O.R.C. §5705.03(B)

and Requests a Rate for Renewal or Renewal With a Decrease Levies

(Do not use this worksheet for school emergency levies, renewal with increase levies or substitute levies.)

Calculation of Millage Rate

Tax Value

Millage Rate

Revenue

1. Class I Real – Res/Ag

$

X

.

÷ 1,000 =

$

2. Class II Real – Other

$

X

.

÷ 1,000 =

$

3. Public Utility Personal

$

X

.

÷ 1,000 =

$

4. General Personal

$

X

.

÷ 1,000 =

$

5. Total Projected Revenue as Taxes

$

6. Personal Property Phase-out Reimbursement Payment

$

7. Requested Revenue

$

8. Amount to be Charged as Tax

$

9. Ratio (line 8 ÷ line 5)

.

10. Existing Authorized Rate

.

11. Certifi ed Millage Rate

.

Instructions

Line 1. Enter tax valuation of all Class I real property (residential and agricultural property) included on the tax

list most recently certifi ed for collection. Enter the existing effective tax rate in mills for Class I. Multiply the tax

value times the rate and divide by 1,000 to get tax revenue in dollars.

Line 2. Enter tax valuation of all Class II real property (all other real property) included on the tax list most recently

certifi ed for collection. Enter the existing effective tax rate in mills for Class II. Multiply the tax value times the rate

and divide by 1,000 to get tax revenue in dollars.

Line 3. Enter the estimated valuation of public utility personal property for the fi rst tax year the levy will be assessed

against public utility personal property. To determine the public utility valuation, please refer to the values in the

appropriate spreadsheet available at:

Note: Public utility personal property taxes are assessed at the same time as real property taxes, except,

beginning in 2007, telecommunications property. The public utility values in the spreadsheets refl ect the shift of

telecommunications property to general business property.

Enter the existing authorized (gross) tax rate in mills. Multiply the tax value times the rate and divide by 1,000 to

get tax revenue in dollars.

Line 4. Using the estimated values published on the Department of Taxation’s Web site at the address provided

above, enter the estimated general personal property value for the fi rst general personal property tax year the levy

will be collected. (Note: If the fi rst year for which the levy will be assessed against real property is tax year 2008,

then the fi rst tax year that levy will be assessed against personal property will be 2009.) Since telecommunications

companies are the only general businesses that are still liable for the personal property tax, and then only for tax

1

1 2

2