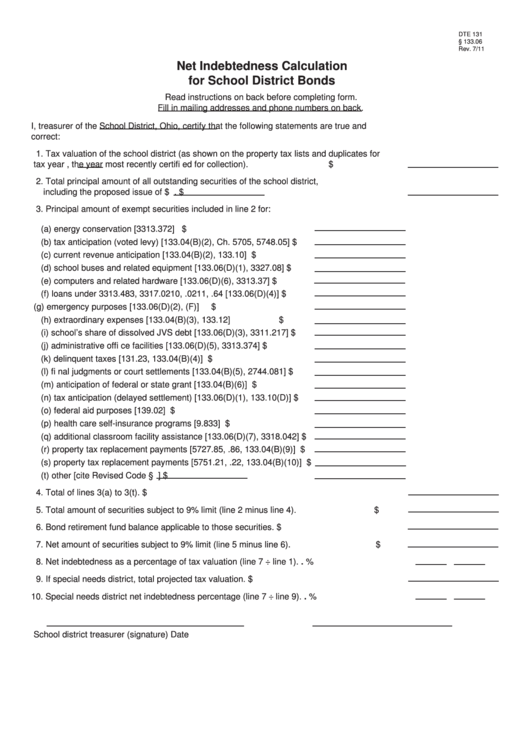

DTE 131

Reset Form

R.C. § 133.06

Rev. 7/11

Net Indebtedness Calculation

for School District Bonds

Read instructions on back before completing form.

Fill in mailing addresses and phone numbers on back.

I, treasurer of the

School District, Ohio, certify that the following statements are true and

correct:

1. Tax valuation of the school district (as shown on the property tax lists and duplicates for

tax year

, the year most recently certifi ed for collection).

$

2. Total principal amount of all outstanding securities of the school district,

including the proposed issue of $

.

$

3. Principal amount of exempt securities included in line 2 for:

(a) energy conservation [3313.372]

$

(b) tax anticipation (voted levy) [133.04(B)(2), Ch. 5705, 5748.05]

$

(c) current revenue anticipation [133.04(B)(2), 133.10]

$

(d) school buses and related equipment [133.06(D)(1), 3327.08]

$

(e) computers and related hardware [133.06(D)(6), 3313.37]

$

(f) loans under 3313.483, 3317.0210, .0211, .64 [133.06(D)(4)]

$

(g) emergency purposes [133.06(D)(2), (F)]

$

(h) extraordinary expenses [133.04(B)(3), 133.12]

$

(i) school’s share of dissolved JVS debt [133.06(D)(3), 3311.217]

$

(j) administrative offi ce facilities [133.06(D)(5), 3313.374]

$

(k) delinquent taxes [131.23, 133.04(B)(4)]

$

(l) fi nal judgments or court settlements [133.04(B)(5), 2744.081]

$

(m) anticipation of federal or state grant [133.04(B)(6)]

$

(n) tax anticipation (delayed settlement) [133.06(D)(1), 133.10(D)]

$

(o) federal aid purposes [139.02]

$

(p) health care self-insurance programs [9.833]

$

(q) additional classroom facility assistance [133.06(D)(7), 3318.042] $

(r) property tax replacement payments [5727.85, .86, 133.04(B)(9)]

$

(s) property tax replacement payments [5751.21, .22, 133.04(B)(10)] $

(t) other [cite Revised Code §

]

$

4. Total of lines 3(a) to 3(t).

$

5. Total amount of securities subject to 9% limit (line 2 minus line 4).

$

6. Bond retirement fund balance applicable to those securities.

$

7. Net amount of securities subject to 9% limit (line 5 minus line 6).

$

8. Net indebtedness as a percentage of tax valuation (line 7 ÷ line 1).

.

%

9. If special needs district, total projected tax valuation.

$

10. Special needs district net indebtedness percentage (line 7 ÷ line 9).

.

%

School district treasurer (signature)

Date

1

1 2

2