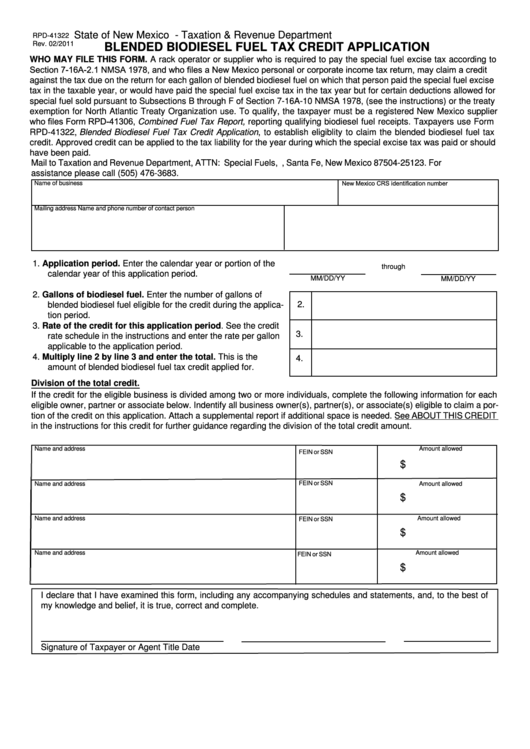

State of New Mexico - Taxation & Revenue Department

RPD-41322

Rev. 02/2011

BLENDED BIODIESEL FUEL TAX CREDIT APPLICATION

WHO MAY FILE THIS FORM. A rack operator or supplier who is required to pay the special fuel excise tax according to

Section 7-16A-2.1 NMSA 1978, and who files a New Mexico personal or corporate income tax return, may claim a credit

against the tax due on the return for each gallon of blended biodiesel fuel on which that person paid the special fuel excise

tax in the taxable year, or would have paid the special fuel excise tax in the tax year but for certain deductions allowed for

special fuel sold pursuant to Subsections B through F of Section 7-16A-10 NMSA 1978, (see the instructions) or the treaty

exemption for North Atlantic Treaty Organization use. To qualify, the taxpayer must be a registered New Mexico supplier

who files Form RPD-41306, Combined Fuel Tax Report, reporting qualifying biodiesel fuel receipts. Taxpayers use Form

RPD-41322, Blended Biodiesel Fuel Tax Credit Application, to establish eligiblity to claim the blended biodiesel fuel tax

credit. Approved credit can be applied to the tax liability for the year during which the special excise tax was paid or should

have been paid.

Mail to Taxation and Revenue Department, ATTN: Special Fuels, P.O. Box 25123, Santa Fe, New Mexico 87504-25123. For

assistance please call (505) 476-3683.

New Mexico CRS identification number

Name of business

Mailing address

Name and phone number of contact person

1. Application period. Enter the calendar year or portion of the

through

calendar year of this application period.

MM/DD/YY

MM/DD/YY

2. Gallons of biodiesel fuel. Enter the number of gallons of

2.

blended biodiesel fuel eligible for the credit during the applica-

tion period.

3. Rate of the credit for this application period. See the credit

3.

rate schedule in the instructions and enter the rate per gallon

applicable to the application period.

4. Multiply line 2 by line 3 and enter the total. This is the

4.

amount of blended biodiesel fuel tax credit applied for.

Division of the total credit.

If the credit for the eligible business is divided among two or more individuals, complete the following information for each

eligible owner, partner or associate below. Indentify all business owner(s), partner(s), or associate(s) eligible to claim a por-

tion of the credit on this application. Attach a supplemental report if additional space is needed. See ABOUT THIS CREDIT

in the instructions for this credit for further guidance regarding the division of the total credit amount.

Name and address

Amount allowed

FEIN or SSN

$

FEIN or SSN

Name and address

Amount allowed

$

Name and address

Amount allowed

FEIN or SSN

$

Name and address

Amount allowed

FEIN or SSN

$

I declare that I have examined this form, including any accompanying schedules and statements, and, to the best of

my knowledge and belief, it is true, correct and complete.

Signature of Taxpayer or Agent

Title

Date

1

1 2

2