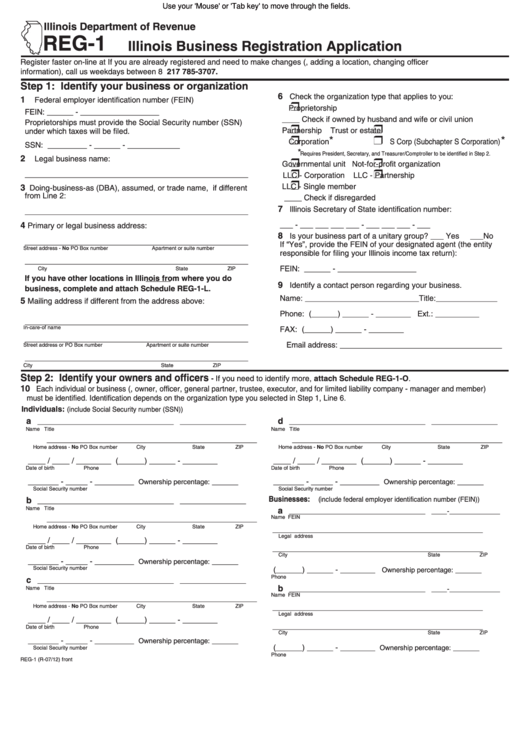

Use your 'Mouse' or 'Tab key' to move through the fields.

Illinois Department of Revenue

REG-1

Illinois Business Registration Application

Register faster on-line at tax.illinois.gov. If you are already registered and need to make changes (e.g., adding a location, changing officer

information), call us weekdays between 8 a.m. and 5 p.m. at 217 785-3707.

Step 1: Identify your business or organization

6

Check the organization type that applies to you:

1

Federal employer identification number (FEIN)

Proprietorship

FEIN: ______ - __________________

____ Check if owned by husband and wife or civil union

Proprietorships must provide the Social Security number (SSN)

Partnership

Trust or estate

under which taxes will be filed.

*

*

Corporation

S Corp (Subchapter S Corporation)

SSN: _________ - ______ - ____________

*

Requires President, Secretary, and Treasurer/Comptroller to be identified in Step 2.

2

Legal business name:

Governmental unit

Not-for-profit organization

___________________________________________________

LLC - Corporation

LLC - Partnership

LLC - Single member

3

Doing-business-as (DBA), assumed, or trade name, if different

from Line 2:

____ Check if disregarded

7

Illinois Secretary of State identification number:

___________________________________________________

___ - ___ ___ ___ ___ - ___ ___ ___ - ___

4

Primary or legal business address:

8

Is your business part of a unitary group? ___ Yes

___No

___________________________________________________

If “Yes”, provide the FEIN of your designated agent (the entity

Street address - No PO Box number

Apartment or suite number

responsible for filing your Illinois income tax return):

___________________________________________________

FEIN: ______ - __________________

City

State

ZIP

If you have other locations in Illinois from where you do

9

Identify a contact person regarding your business.

business, complete and attach Schedule REG-1-L.

Name: __________________________Title:______________

5

Mailing address if different from the address above:

Phone: (______) ______ - ________ Ext.: __________

___________________________________________________

In-care-of name

FAX:

(______) ______ - ________

___________________________________________________

Email address: _____________________________________

Street address or PO Box number

Apartment or suite number

___________________________________________________

City

State

ZIP

Step 2: Identify your owners and officers

- If you need to identify more, attach Schedule REG-1-O.

10

Each individual or business (i.e., owner, officer, general partner, trustee, executor, and for limited liability company - manager and member)

must be identified. Identification depends on the organization type you selected in Step 1, Line 6.

Individuals:

(include Social Security number (SSN))

a

d

___________________________________

_________________

___________________________________

_________________

Name

Title

Name

Title

______________________________________________________

______________________________________________________

Home address - No PO Box number

City

State

ZIP

Home address - No PO Box number

City

State

ZIP

____ / ____ / ________

(______) ______ - ________

____ / ____ / ________

(______) ______ - ________

Date of birth

Phone

Date of birth

Phone

_______ - _____ - _________

______

_______ - _____ - _________

______

Ownership percentage:

Ownership percentage:

Social Security number

Social Security number

Businesses:

b

(include federal employer identification number (FEIN))

___________________________________

_________________

Name

Title

a

___________________________________ ____-_____________

Name

FEIN

______________________________________________________

Home address - No PO Box number

City

State

ZIP

______________________________________________________

Legal address

____ / ____ / ________

(______) ______ - ________

Date of birth

Phone

______________________________________________________

City

State

ZIP

_______ - _____ - _________

______

Ownership percentage:

Social Security number

(______) ______ - ________

______

Ownership percentage:

Phone

c

___________________________________

_________________

b

Name

Title

___________________________________ ____-_____________

Name

FEIN

______________________________________________________

Home address - No PO Box number

City

State

ZIP

______________________________________________________

Legal address

____ / ____ / ________

(______) ______ - ________

______________________________________________________

Date of birth

Phone

City

State

ZIP

_______ - _____ - _________

______

Ownership percentage:

(______) ______ - ________

______

Ownership percentage:

Social Security number

Phone

REG-1 (R-07/12) front

1

1 2

2