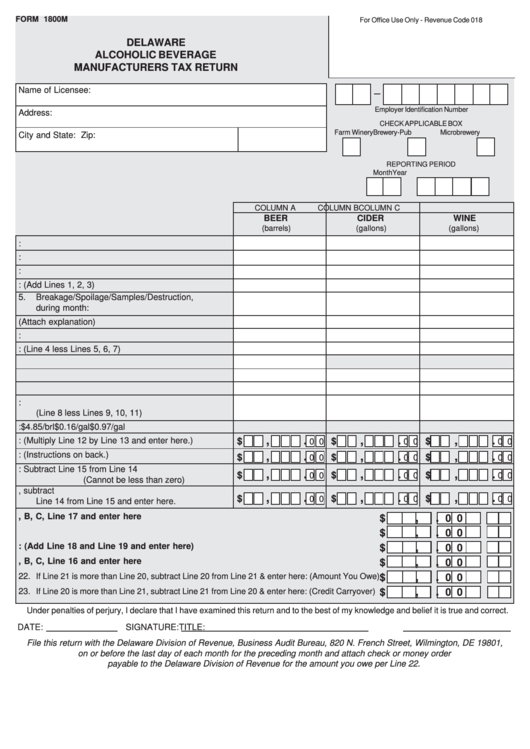

FORM 1800M

For Office Use Only - Revenue Code 018

DELAWARE

ALCOHOLIC BEVERAGE

MANUFACTURERS TAX RETURN

Name of Licensee:

Employer Identification Number

Address:

CHECK APPLICABLE BOX

Farm Winery

Brewery-Pub

Microbrewery

City and State:

Zip:

REPORTING PERIOD

Month

Year

COLUMN A

COLUMN B

COLUMN C

BEER

CIDER

WINE

(barrels)

(gallons)

(gallons)

1.

Inventory at beginning of month:

2.

Quantity produced during month:

3.

Returns from prior month sales:

4.

TOTAL: (Add Lines 1, 2, 3)

5.

Breakage/Spoilage/Samples/Destruction,

during month:

6.

Other inventory loses (Attach explanation)

7.

Inventory at end of month:

8.

TOTAL: (Line 4 less Lines 5, 6, 7)

9.

Tax Exempt Sales - Military

-- -- -- N / A -- -- --

-- -- -- N / A -- -- --

10. Tax Exempt Sales - Out of State

11. Tax Exempt Sales - to Importers

12. Net Taxable Quantity Sold During Month:

(Line 8 less Lines 9, 10, 11)

13. TAX RATE:

$4.85/brl

$0.16/gal

$0.97/gal

,

.

,

.

,

.

14. TAX: (Multiply Line 12 by Line 13 and enter here.)

$

$

$

0 0

0 0

0 0

15. Current Months Credits: (Instructions on back.)

,

.

,

.

,

.

$

$

$

0 0

0 0

0 0

16. BALANCE: Subtract Line 15 from Line 14

,

.

,

.

,

.

$

$

$

0 0

0 0

0 0

(Cannot be less than zero)

17. If Line 15 is more than Line 14, subtract

,

.

,

.

,

.

$

$

$

0 0

0 0

0 0

Line 14 from Line 15 and enter here.

18. Add Columns A, B, C, Line 17 and enter here .......................................................

,

.

$

0 0

19. Credit Carryover from Prior Month .........................................................................

,

.

$

0 0

20. Total Overpayment: (Add Line 18 and Line 19 and enter here) ..............................

,

.

$

0 0

,

.

21. Add Columns A, B, C, Line 16 and enter here ........................................................

$

0 0

,

.

22.

If Line 21 is more than Line 20, subtract Line 20 from Line 21 & enter here: (Amount You Owe)

$

0 0

,

.

23.

If Line 20 is more than Line 21, subtract Line 21 from Line 20 & enter here: (Credit Carryover)

$

0 0

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true and correct.

DATE:

SIGNATURE:

TITLE:

File this return with the Delaware Division of Revenue, Business Audit Bureau, 820 N. French Street, Wilmington, DE 19801,

on or before the last day of each month for the preceding month and attach check or money order

payable to the Delaware Division of Revenue for the amount you owe per Line 22.

1

1 2

2