Form Rpd-41310 - Taxation And Revenue Department

ADVERTISEMENT

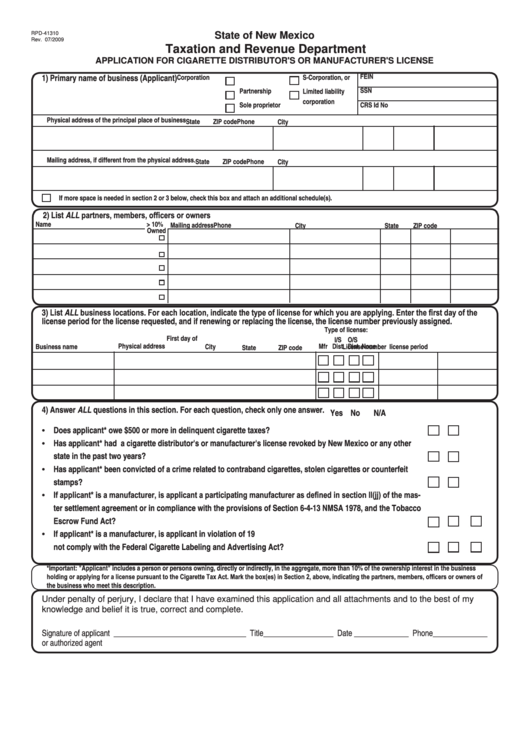

RPD-41310

State of New Mexico

Rev. 07/2009

Taxation and Revenue Department

APPLICATION FOR CIGARETTE DISTRIBUTOR'S OR MANUFACTURER'S LICENSE

FEIN

1) Primary name of business (Applicant)

Corporation

S-Corporation, or

SSN

Partnership

Limited liability

corporation

Sole proprietor

CRS Id No

Physical address of the principal place of business

State

ZIP code

Phone

City

Mailing address, if different from the physical address.

State

ZIP code

Phone

City

If more space is needed in section 2 or 3 below, check this box and attach an additional schedule(s).

2) List ALL partners, members, officers or owners

Name

> 10%

Mailing address

City

State

ZIP code

Phone

Owned

3) List ALL business locations. For each location, indicate the type of license for which you are applying. Enter the first day of the

license period for the license requested, and if renewing or replacing the license, the license number previously assigned.

Type of license:

First day of

I/S O/S

Physical address

Mfr Dist Dist None

Business name

City

license period

License number

State

ZIP code

4) Answer ALL questions in this section. For each question, check only one answer.

Yes No

N/A

• Does applicant* owe $500 or more in delinquent cigarette taxes? ...........................................................................

• Has applicant* had a cigarette distributor's or manufacturer's license revoked by New Mexico or any other

state in the past two years? ..........................................................................................................................................

• Has applicant* been convicted of a crime related to contraband cigarettes, stolen cigarettes or counterfeit

stamps? ...........................................................................................................................................................................

• If applicant* is a manufacturer, is applicant a participating manufacturer as defined in section II(jj) of the mas-

ter settlement agreement or in compliance with the provisions of Section 6-4-13 NMSA 1978, and the Tobacco

Escrow Fund Act? ..........................................................................................................................................................

• If applicant* is a manufacturer, is applicant in violation of 19 U.S.C. 1681a or manufacturing cigarettes that do

not comply with the Federal Cigarette Labeling and Advertising Act? .....................................................................

*Important: "Applicant" includes a person or persons owning, directly or indirectly, in the aggregate, more than 10% of the ownership interest in the business

holding or applying for a license pursuant to the Cigarette Tax Act. Mark the box(es) in Section 2, above, indicating the partners, members, officers or owners of

the business who meet this description.

Under penalty of perjury, I declare that I have examined this application and all attachments and to the best of my

knowledge and belief it is true, correct and complete.

Signature of applicant __________________________________ Title__________________ Date ______________ Phone______________

or authorized agent

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4