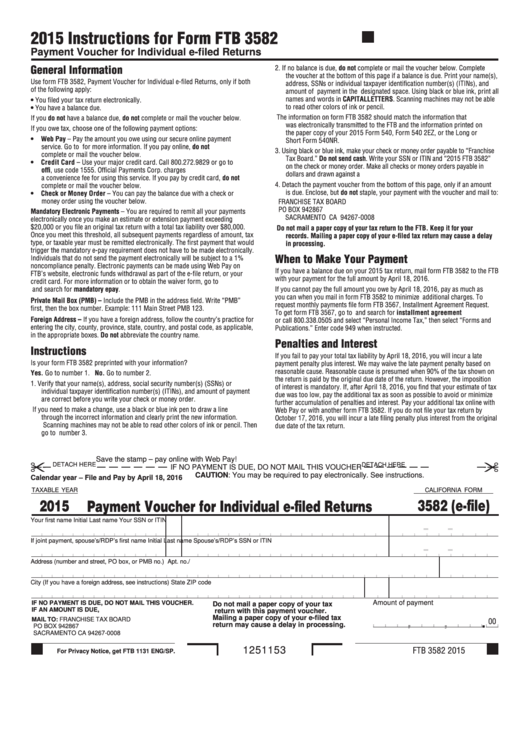

2015 Instructions for Form FTB 3582

Payment Voucher for Individual e-filed Returns

General Information

2. If no balance is due, do not complete or mail the voucher below. Complete

the voucher at the bottom of this page if a balance is due. Print your name(s),

Use form FTB 3582, Payment Voucher for Individual e-filed Returns, only if both

address, SSNs or individual taxpayer identification number(s) (ITINs), and

of the following apply:

amount of payment in the designated space. Using black or blue ink, print all

names and words in CAPITAL LETTERS. Scanning machines may not be able

•

You filed your tax return electronically.

to read other colors of ink or pencil.

•

You have a balance due.

The information on form FTB 3582 should match the information that

If you do not have a balance due, do not complete or mail the voucher below.

was electronically transmitted to the FTB and the information printed on

If you owe tax, choose one of the following payment options:

the paper copy of your 2015 Form 540, Form 540 2EZ, or the Long or

•

Web Pay – Pay the amount you owe using our secure online payment

Short Form 540NR.

service. Go to ftb.ca.gov for more information. If you pay online, do not

3. Using black or blue ink, make your check or money order payable to “Franchise

complete or mail the voucher below.

Tax Board.” Do not send cash. Write your SSN or ITIN and “2015 FTB 3582”

•

Credit Card – Use your major credit card. Call 800.272.9829 or go to

on the check or money order. Make all checks or money orders payable in U.S.

, use code 1555. Official Payments Corp. charges

dollars and drawn against a U.S. financial institution.

a convenience fee for using this service. If you pay by credit card, do not

4. Detach the payment voucher from the bottom of this page, only if an amount

complete or mail the voucher below.

is due. Enclose, but do not staple, your payment with the voucher and mail to:

•

Check or Money Order – You can pay the balance due with a check or

money order using the voucher below.

FRANCHISE TAX BOARD

PO BOX 942867

Mandatory Electronic Payments – You are required to remit all your payments

SACRAMENTO CA 94267-0008

electronically once you make an estimate or extension payment exceeding

$20,000 or you file an original tax return with a total tax liability over $80,000.

Do not mail a paper copy of your tax return to the FTB. Keep it for your

Once you meet this threshold, all subsequent payments regardless of amount, tax

records. Mailing a paper copy of your e-filed tax return may cause a delay

type, or taxable year must be remitted electronically. The first payment that would

in processing.

trigger the mandatory e-pay requirement does not have to be made electronically.

When to Make Your Payment

Individuals that do not send the payment electronically will be subject to a 1%

noncompliance penalty. Electronic payments can be made using Web Pay on

If you have a balance due on your 2015 tax return, mail form FTB 3582 to the FTB

FTB’s website, electronic funds withdrawal as part of the e-file return, or your

with your payment for the full amount by April 18, 2016.

credit card. For more information or to obtain the waiver form, go to

ftb.ca.gov and search for mandatory epay.

If you cannot pay the full amount you owe by April 18, 2016, pay as much as

you can when you mail in form FTB 3582 to minimize additional charges. To

Private Mail Box (PMB) – Include the PMB in the address field. Write “PMB”

request monthly payments file form FTB 3567, Installment Agreement Request.

first, then the box number. Example: 111 Main Street PMB 123.

To get form FTB 3567, go to ftb.ca.gov and search for installment agreement

Foreign Address – If you have a foreign address, follow the country’s practice for

or call 800.338.0505 and select “Personal Income Tax,” then select “Forms and

entering the city, county, province, state, country, and postal code, as applicable,

Publications.” Enter code 949 when instructed.

in the appropriate boxes. Do not abbreviate the country name.

Penalties and Interest

Instructions

If you fail to pay your total tax liability by April 18, 2016, you will incur a late

Is your form FTB 3582 preprinted with your information?

payment penalty plus interest. We may waive the late payment penalty based on

reasonable cause. Reasonable cause is presumed when 90% of the tax shown on

Yes. Go to number 1.

No. Go to number 2.

the return is paid by the original due date of the return. However, the imposition

1. Verify that your name(s), address, social security number(s) (SSNs) or

of interest is mandatory. If, after April 18, 2016, you find that your estimate of tax

individual taxpayer identification number(s) (ITINs), and amount of payment

due was too low, pay the additional tax as soon as possible to avoid or minimize

are correct before you write your check or money order.

further accumulation of penalties and interest. Pay your additional tax online with

If you need to make a change, use a black or blue ink pen to draw a line

Web Pay or with another form FTB 3582. If you do not file your tax return by

through the incorrect information and clearly print the new information.

October 17, 2016, you will incur a late filing penalty plus interest from the original

Scanning machines may not be able to read other colors of ink or pencil. Then

due date of the tax return.

go to number 3.

Save the stamp – pay online with Web Pay!

DETACH HERE

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER

CAUTION: You may be required to pay electronically. See instructions.

Calendar year – File and Pay by April 18, 2016

TAXABLE YEAR

CALIFORNIA FORM

2015

3582 (e-file)

Payment Voucher for Individual e-filed Returns

Your first name

Initial Last name

Your SSN or ITIN

If joint payment, spouse’s/RDP’s first name

Initial Last name

Spouse’s/RDP’s SSN or ITIN

Address (number and street, PO box, or PMB no.)

Apt. no./Ste.no.

City (If you have a foreign address, see instructions)

State

ZIP code

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER.

Do not mail a paper copy of your tax

Amount of payment

IF AN AMOUNT IS DUE,

return with this payment voucher.

Mailing a paper copy of your e-filed tax

MAIL TO: FRANCHISE TAX BOARD

00

.

,

,

return may cause a delay in processing.

PO BOX 942867

SACRAMENTO CA 94267-0008

1251153

FTB 3582 2015

For Privacy Notice, get FTB 1131 ENG/SP.

1

1