Print

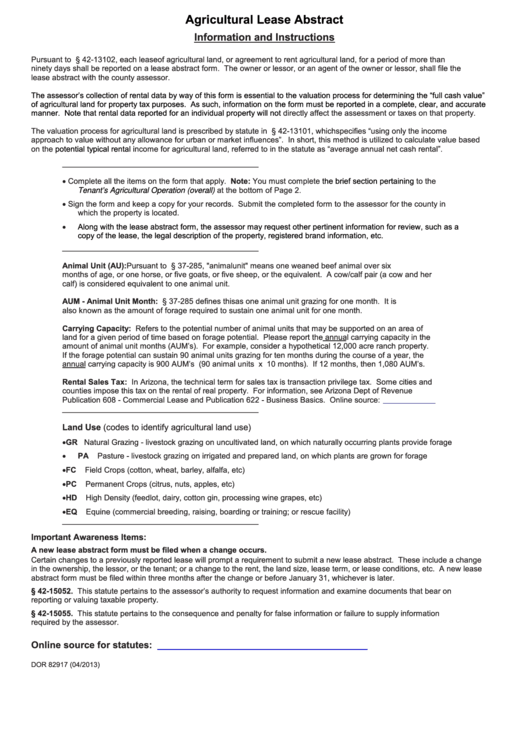

Agricultural Lease Abstract

Clear Form

Information and Instructions

Pursuant to A.R.S. § 42-13102, each lease of agricultural land, or agreement to rent agricultural land, for a period of more than

ninety days shall be reported on a lease abstract form. The owner or lessor, or an agent of the owner or lessor, shall file the

lease abstract with the county assessor.

The assessor’s collection of rental data by way of this form is essential to the valuation process for determining the “full cash value”

of agricultural land for property tax purposes. As such, information on the form must be reported in a complete, clear, and accurate

manner. Note that rental data reported for an individual property will not

directly affect the assessment or taxes on that property.

The valuation process for agricultural land is prescribed by statute in A.R.S. § 42-13101, which specifies “using only the income

approach to value without any allowance for urban or market influences”. In short, this method is utilized to calculate value based

on the

potential typical rental

income for agricultural land, referred to in the statute as “average annual net cash rental”.

_____________________________________________

Complete all the items on the form that apply. Note: You must complete

the brief section pertaining

to the

at the bottom of Page 2.

Tenant’s Agricultural Operation (overall)

Sign the form and keep a copy for your records. Submit the completed form to the assessor for the county in

which the property is located.

Along with the lease abstract form, the assessor may request other pertinent information for review, such as a

copy of the lease, the legal description of the property, registered brand information, etc.

_____________________________________________

Animal Unit (AU): Pursuant to A.R.S. § 37-285, "animal unit" means one weaned beef animal over six

months of age, or one horse, or five goats, or five sheep, or the equivalent. A cow/calf pair (a cow and her

calf) is considered equivalent to one animal unit.

AUM - Animal Unit Month: A.R.S. § 37-285 defines this as one animal unit grazing for one month. It is

also known as the amount of forage required to sustain one animal unit for one month.

Carrying Capacity: Refers to the potential number of animal units that may be supported on an area of

land for a given period of time based on forage potential. Please report the annual carrying capacity in the

amount of animal unit months (AUM’s). For example, consider a hypothetical 12,000 acre ranch property.

If the forage potential can sustain 90 animal units grazing for ten months during the course of a year, the

annual carrying capacity is 900 AUM’s (90 animal units x 10 months). If 12 months, then 1,080 AUM’s.

Rental Sales Tax: In Arizona, the technical term for sales tax is transaction privilege tax. Some cities and

counties impose this tax on the rental of real property. For information, see Arizona Dept of Revenue

Publication 608 - Commercial Lease and Publication 622 - Business Basics. Online source:

_____________________________________________

Land Use (codes to identify agricultural land use)

GR Natural Grazing - livestock grazing on uncultivated land, on which naturally occurring plants provide forage

PA

Pasture - livestock grazing on irrigated and prepared land, on which plants are grown for forage

FC

Field Crops (cotton, wheat, barley, alfalfa, etc)

PC

Permanent Crops (citrus, nuts, apples, etc)

HD

High Density (feedlot, dairy, cotton gin, processing wine grapes, etc)

EQ

Equine (commercial breeding, raising, boarding or training; or rescue facility)

_____________________________________________

Important Awareness Items:

A new lease abstract form must be filed when a change occurs.

Certain changes to a previously reported lease will prompt a requirement to submit a new lease abstract. These include a change

in the ownership, the lessor, or the tenant; or a change to the rent, the land size, lease term, or lease conditions, etc. A new lease

abstract form must be filed within three months after the change or before January 31, whichever is later.

A.R.S. § 42-15052. This statute pertains to the assessor’s authority to request information and examine documents that bear on

reporting or valuing taxable property.

A.R.S. § 42-15055. This statute pertains to the consequence and penalty for false information or failure to supply information

required by the assessor.

Online source for statutes:

DOR 82917 (04/2013)

1

1 2

2 3

3