Reset Form

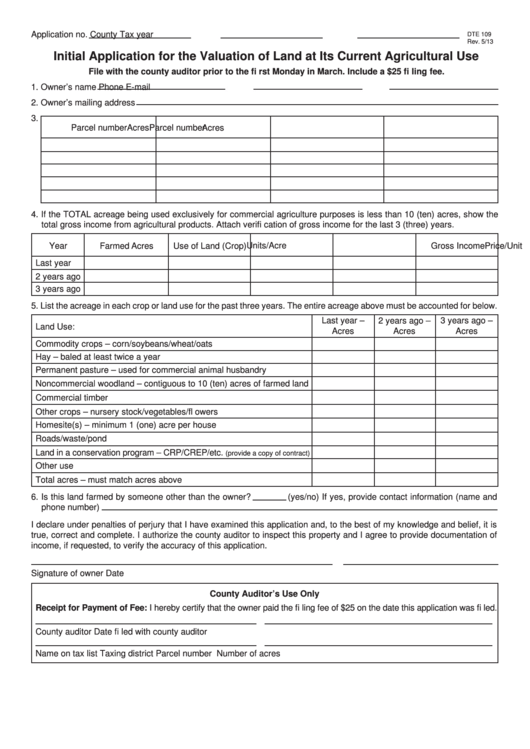

Application no.

County

Tax year

DTE 109

Rev. 5/13

Initial Application for the Valuation of Land at Its Current Agricultural Use

File with the county auditor prior to the fi rst Monday in March. Include a $25 fi ling fee.

1. Owner’s name

Phone

E-mail

2. Owner’s mailing address

3.

Parcel number

Acres

Parcel number

Acres

4. If the TOTAL acreage being used exclusively for commercial agriculture purposes is less than 10 (ten) acres, show the

total gross income from agricultural products. Attach verifi cation of gross income for the last 3 (three) years.

Year

Farmed Acres

Units/Acre

Price/Unit

Gross Income

Use of Land (Crop)

Last year

2 years ago

3 years ago

5. List the acreage in each crop or land use for the past three years. The entire acreage above must be accounted for below.

Last year –

2 years ago –

3 years ago –

Land Use:

Acres

Acres

Acres

Commodity crops – corn/soybeans/wheat/oats

Hay – baled at least twice a year

Permanent pasture – used for commercial animal husbandry

Noncommercial woodland – contiguous to 10 (ten) acres of farmed land

Commercial timber

Other crops – nursery stock/vegetables/fl owers

Homesite(s) – minimum 1 (one) acre per house

Roads/waste/pond

Land in a conservation program – CRP/CREP/etc.

(provide a copy of contract)

Other use

Total acres – must match acres above

6. Is this land farmed by someone other than the owner?

(yes/no) If yes, provide contact information (name and

phone number)

I declare under penalties of perjury that I have examined this application and, to the best of my knowledge and belief, it is

true, correct and complete. I authorize the county auditor to inspect this property and I agree to provide documentation of

income, if requested, to verify the accuracy of this application.

Signature of owner

Date

County Auditor’s Use Only

Receipt for Payment of Fee: I hereby certify that the owner paid the fi ling fee of $25 on the date this application was fi led.

County auditor

Date fi led with county auditor

Name on tax list

Taxing district

Parcel number

Number of acres

1

1 2

2