Reset Form

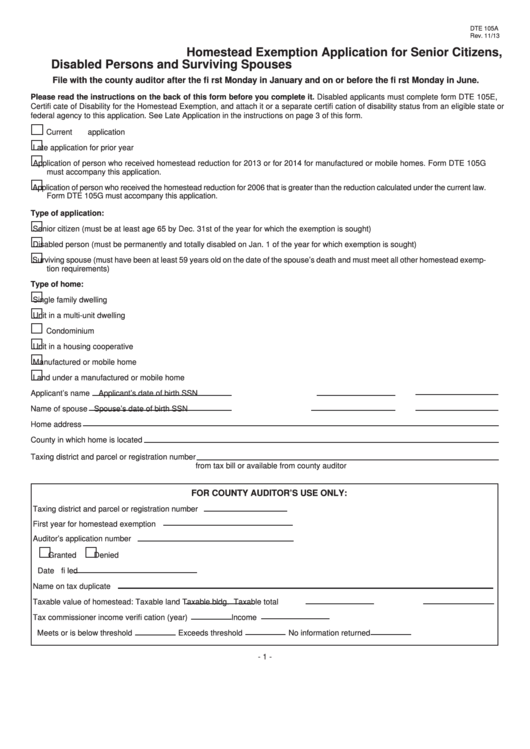

DTE 105A

Rev. 11/13

Homestead Exemption Application for Senior Citizens,

Disabled Persons and Surviving Spouses

File with the county auditor after the fi rst Monday in January and on or before the fi rst Monday in June.

Please read the instructions on the back of this form before you complete it. Disabled applicants must complete form DTE 105E,

Certifi cate of Disability for the Homestead Exemption, and attach it or a separate certifi cation of disability status from an eligible state or

federal agency to this application. See Late Application in the instructions on page 3 of this form.

Current application

Late application for prior year

Application of person who received homestead reduction for 2013 or for 2014 for manufactured or mobile homes. Form DTE 105G

must accompany this application.

Application of person who received the homestead reduction for 2006 that is greater than the reduction calculated under the current law.

Form DTE 105G must accompany this application.

Type of application:

Senior citizen (must be at least age 65 by Dec. 31st of the year for which the exemption is sought)

Disabled person (must be permanently and totally disabled on Jan. 1 of the year for which exemption is sought)

Surviving spouse (must have been at least 59 years old on the date of the spouse’s death and must meet all other homestead exemp-

tion requirements)

Type of home:

Single family dwelling

Unit in a multi-unit dwelling

Condominium

Unit in a housing cooperative

Manufactured or mobile home

Land under a manufactured or mobile home

Applicant’s name

Applicant’s date of birth

SSN

Name of spouse

Spouse’s date of birth

SSN

Home address

County in which home is located

Taxing district and parcel or registration number

from tax bill or available from county auditor

FOR COUNTY AUDITOR’S USE ONLY:

Taxing district and parcel or registration number

First year for homestead exemption

Auditor’s application number

Granted

Denied

Date fi led

Name on tax duplicate

Taxable value of homestead: Taxable land

Taxable bldg.

Taxable total

Tax commissioner income verifi cation (year)

Income

Meets or is below threshold

Exceeds threshold

No information returned

- 1 -

1

1 2

2 3

3