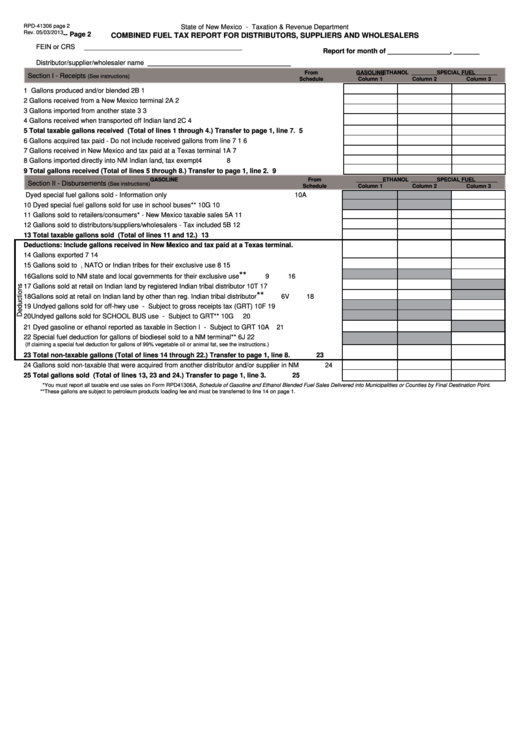

RPD-41306 page 2

State of New Mexico - Taxation & Revenue Department

Rev. 05/03/2013

-- Page 2

COMBINED FUEL TAX REPORT FOR DISTRIBUTORS, SUPPLIERS AND WHOLESALERS

FEIN or CRS

___________________________________________

Report for month of _________________, _______

Distributor/supplier/wholesaler name _______________________________________

From

GASOLINE

ETHANOL

SPECIAL FUEL

Section I - Receipts

(See instructions)

Schedule

Column 1

Column 2

Column 3

1

Gallons produced and/or blended

2B

1

2

Gallons received from a New Mexico terminal

2A

2

3

Gallons imported from another state

3

3

4

Gallons received when transported off Indian land

2C

4

5

Total taxable gallons received (Total of lines 1 through 4.) Transfer to page 1, line 7.

5

6

Gallons acquired tax paid - Do not include received gallons from line 7

1

6

7

Gallons received in New Mexico and tax paid at a Texas terminal

1A

7

8

Gallons imported directly into NM Indian land, tax exempt

4

8

9

Total gallons received (Total of lines 5 through 8.) Transfer to page 1, line 2.

9

From

GASOLINE

ETHANOL

SPECIAL FUEL

Section II - Disbursements

(See instructions)

Schedule

Column 1

Column 2

Column 3

Dyed special fuel gallons sold - Information only

10A

10 Dyed special fuel gallons sold for use in school buses**

10G

10

11 Gallons sold to retailers/consumers* - New Mexico taxable sales

5A

11

12 Gallons sold to distributors/suppliers/wholesalers - Tax included

5B

12

13 Total taxable gallons sold (Total of lines 11 and 12.)

13

Deductions: Include gallons received in New Mexico and tax paid at a Texas terminal.

14 Gallons exported

7

14

15 Gallons sold to U.S. Govt., NATO or Indian tribes for their exclusive use

8

15

**

16 Gallons sold to NM state and local governments for their exclusive use

9

16

17 Gallons sold at retail on Indian land by registered Indian tribal distributor

10T

17

**

18 Gallons sold at retail on Indian land by other than reg. Indian tribal distributor

6V

18

19 Undyed gallons sold for off-hwy use - Subject to gross receipts tax (GRT)

10F

19

20 Undyed gallons sold for SCHOOL BUS use - Subject to GRT**

10G

20

21 Dyed gasoline or ethanol reported as taxable in Section I - Subject to GRT

10A

21

22 Special fuel deduction for gallons of biodiesel sold to a NM terminal**

6J

22

(If claiming a special fuel deduction for gallons of 99% vegetable oil or animal fat, see the instructions.)

23 Total non-taxable gallons (Total of lines 14 through 22.) Transfer to page 1, line 8.

23

24 Gallons sold non-taxable that were acquired from another distributor and/or supplier in NM

24

25 Total gallons sold (Total of lines 13, 23 and 24.) Transfer to page 1, line 3.

25

*You must report all taxable end use sales on Form RPD41306A, Schedule of Gasoline and Ethanol Blended Fuel Sales Delivered into Municipalities or Counties by Final Destination Point.

**These gallons are subject to petroleum products loading fee and must be transferred to line 14 on page 1.

1

1