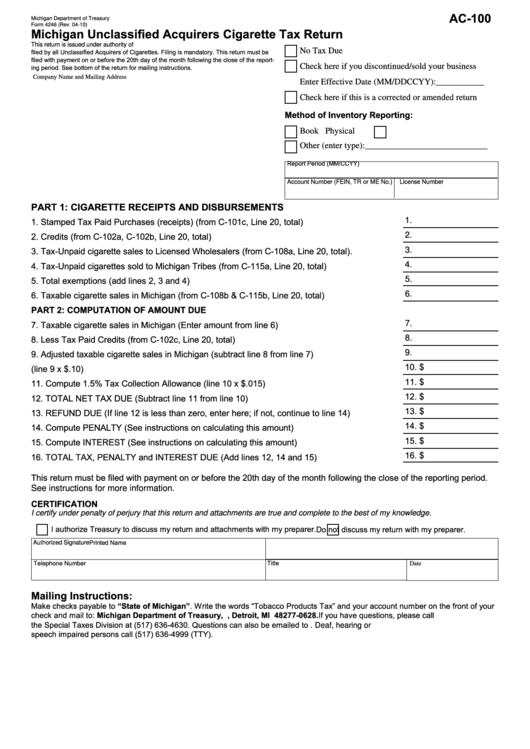

Form 4246 - Michigan Unclassified Acquirers Cigarette Tax Return

ADVERTISEMENT

AC-100

Michigan Department of Treasury

Form 4246 (Rev. 04-10)

Michigan Unclassified Acquirers Cigarette Tax Return

This return is issued under authority of P.A. 327 of 1993 as amended. This form is to be

No Tax Due

filed by all Unclassified Acquirers of Cigarettes. Filing is mandatory. This return must be

filed with payment on or before the 20th day of the month following the close of the report-

Check here if you discontinued/sold your business

ing period. See bottom of the return for mailing instructions.

Company Name and Mailing Address

Enter Effective Date (MM/DDCCYY):___________

Check here if this is a corrected or amended return

Method of Inventory Reporting:

Book

Physical

Other (enter type):____________________________

Report Period (MM/CCYY)

Account Number (FEIN, TR or ME No.)

License Number

PART 1: CIGARETTE RECEIPTS AND DISBURSEMENTS

1. Stamped Tax Paid Purchases (receipts) (from C-101c, Line 20, total) .........................................

1.

2. Credits (from C-102a, C-102b, Line 20, total) ..............................................................................

2.

3. Tax-Unpaid cigarette sales to Licensed Wholesalers (from C-108a, Line 20, total). ....................

3.

4. Tax-Unpaid cigarettes sold to Michigan Tribes (from C-115a, Line 20, total) ...............................

4.

5.

5. Total exemptions (add lines 2, 3 and 4) ........................................................................................

6. Taxable cigarette sales in Michigan (from C-108b & C-115b, Line 20, total) ................................

6.

PART 2: COMPUTATION OF AMOUNT DUE

7. Taxable cigarette sales in Michigan (Enter amount from line 6) ...................................................

7.

8.

8. Less Tax Paid Credits (from C-102c, Line 20, total) .....................................................................

9. Adjusted taxable cigarette sales in Michigan (subtract line 8 from line 7) ....................................

9.

10. $

10.Compute Tax (line 9 x $.10) .........................................................................................................

11. $

11. Compute 1.5% Tax Collection Allowance (line 10 x $.015) .........................................................

12. $

12. TOTAL NET TAX DUE (Subtract line 11 from line 10) ................................................................

13. $

13. REFUND DUE (If line 12 is less than zero, enter here; if not, continue to line 14) ....................

14. $

14. Compute PENALTY (See instructions on calculating this amount) ............................................

15. $

15. Compute INTEREST (See instructions on calculating this amount) ...........................................

16. $

16. TOTAL TAX, PENALTY and INTEREST DUE (Add lines 12, 14 and 15) ...................................

This return must be filed with payment on or before the 20th day of the month following the close of the reporting period.

See instructions for more information.

CERTIFICATION

I certify under penalty of perjury that this return and attachments are true and complete to the best of my knowledge.

I authorize Treasury to discuss my return and attachments with my preparer.

Do not discuss my return with my preparer.

Authorized Signature

Printed Name

Telephone Number

Title

Date

Mailing Instructions:

Make checks payable to “State of Michigan”. Write the words “Tobacco Products Tax” and your account number on the front of your

check and mail to: Michigan Department of Treasury, P.O. Box 77628, Detroit, MI 48277-0628. If you have questions, please call

the Special Taxes Division at (517) 636-4630. Questions can also be emailed to treas_tobaccotaxes@michigan.gov. Deaf, hearing or

speech impaired persons call (517) 636-4999 (TTY).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2