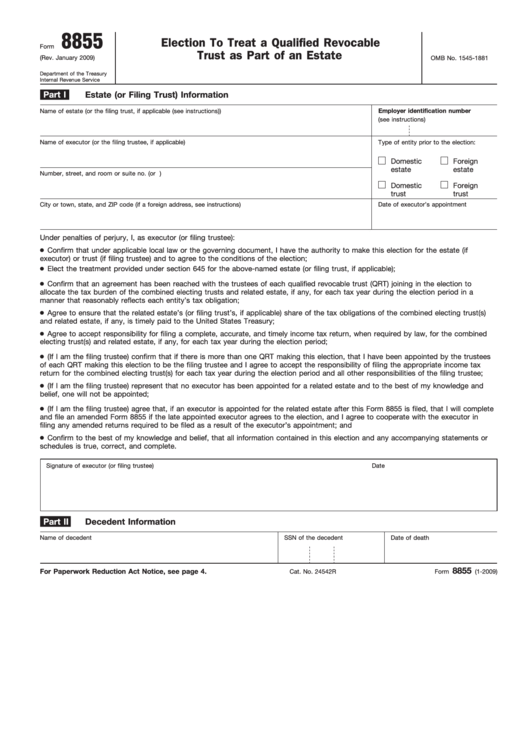

8855

Election To Treat a Qualified Revocable

Form

Trust as Part of an Estate

(Rev. January 2009)

OMB No. 1545-1881

Department of the Treasury

Internal Revenue Service

Part I

Estate (or Filing Trust) Information

Name of estate (or the filing trust, if applicable (see instructions))

Employer identification number

(see instructions)

Name of executor (or the filing trustee, if applicable)

Type of entity prior to the election:

Domestic

Foreign

estate

estate

Number, street, and room or suite no. (or P.O. box number if mail is not delivered to street address)

Domestic

Foreign

trust

trust

Date of executor’s appointment

City or town, state, and ZIP code (if a foreign address, see instructions)

Under penalties of perjury, I, as executor (or filing trustee):

Confirm that under applicable local law or the governing document, I have the authority to make this election for the estate (if

executor) or trust (if filing trustee) and to agree to the conditions of the election;

Elect the treatment provided under section 645 for the above-named estate (or filing trust, if applicable);

Confirm that an agreement has been reached with the trustees of each qualified revocable trust (QRT) joining in the election to

allocate the tax burden of the combined electing trusts and related estate, if any, for each tax year during the election period in a

manner that reasonably reflects each entity’s tax obligation;

Agree to ensure that the related estate’s (or filing trust’s, if applicable) share of the tax obligations of the combined electing trust(s)

and related estate, if any, is timely paid to the United States Treasury;

Agree to accept responsibility for filing a complete, accurate, and timely income tax return, when required by law, for the combined

electing trust(s) and related estate, if any, for each tax year during the election period;

(If I am the filing trustee) confirm that if there is more than one QRT making this election, that I have been appointed by the trustees

of each QRT making this election to be the filing trustee and I agree to accept the responsibility of filing the appropriate income tax

return for the combined electing trust(s) for each tax year during the election period and all other responsibilities of the filing trustee;

(If I am the filing trustee) represent that no executor has been appointed for a related estate and to the best of my knowledge and

belief, one will not be appointed;

(If I am the filing trustee) agree that, if an executor is appointed for the related estate after this Form 8855 is filed, that I will complete

and file an amended Form 8855 if the late appointed executor agrees to the election, and I agree to cooperate with the executor in

filing any amended returns required to be filed as a result of the executor’s appointment; and

Confirm to the best of my knowledge and belief, that all information contained in this election and any accompanying statements or

schedules is true, correct, and complete.

Signature of executor (or filing trustee)

Date

Part II

Decedent Information

Name of decedent

SSN of the decedent

Date of death

8855

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 24542R

Form

(1-2009)

1

1 2

2 3

3 4

4