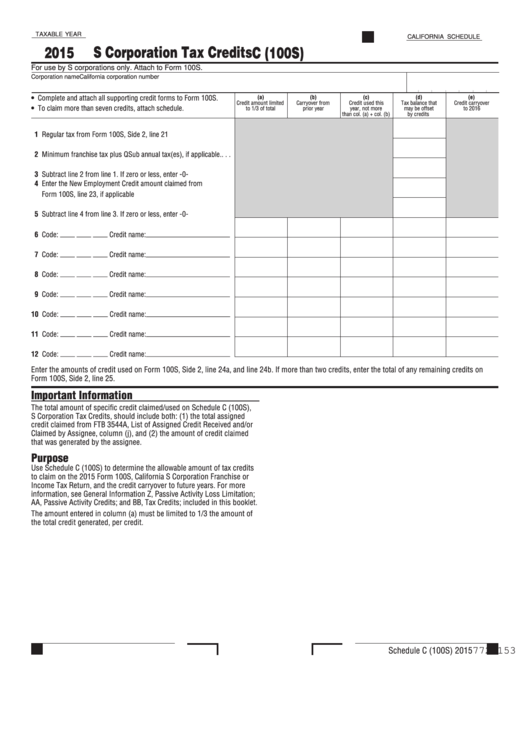

Schedule C (100s) - California S Corporation Tax Credits - 2015

ADVERTISEMENT

TAXABLE YEAR

CALIFORNIA SCHEDULE

2015

S Corporation Tax Credits

C (100S)

For use by S corporations only. Attach to Form 100S.

Corporation name

California corporation number

• Complete and attach all supporting credit forms to Form 100S.

(a)

(b)

(c)

(d)

(e)

Credit amount limited

Carryover from

Credit used this

Tax balance that

Credit carryover

• To claim more than seven credits, attach schedule.

to 1/3 of total

prior year

year, not more

may be offset

to 2016

than col. (a) + col. (b)

by credits

1 Regular tax from Form 100S, Side 2, line 21 . . . . . . . . . . . . . . . . .

2 Minimum franchise tax plus QSub annual tax(es), if applicable. . . .

3 Subtract line 2 from line 1. If zero or less, enter -0- . . . . . . . . . . . .

4 Enter the New Employment Credit amount claimed from

Form 100S, line 23, if applicable. . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Subtract line 4 from line 3. If zero or less, enter -0- . . . . . . . . . . . .

6 Code: ____ ____ ____ Credit name: _______________________

7 Code: ____ ____ ____ Credit name: _______________________

8 Code: ____ ____ ____ Credit name: _______________________

9 Code: ____ ____ ____ Credit name: _______________________

10 Code: ____ ____ ____ Credit name: _______________________

11 Code: ____ ____ ____ Credit name: _______________________

12 Code: ____ ____ ____ Credit name: _______________________

Enter the amounts of credit used on Form 100S, Side 2, line 24a, and line 24b. If more than two credits, enter the total of any remaining credits on

Form 100S, Side 2, line 25.

Important Information

The total amount of specific credit claimed/used on Schedule C (100S),

S Corporation Tax Credits, should include both: (1) the total assigned

credit claimed from FTB 3544A, List of Assigned Credit Received and/or

Claimed by Assignee, column (j), and (2) the amount of credit claimed

that was generated by the assignee.

Purpose

Use Schedule C (100S) to determine the allowable amount of tax credits

to claim on the 2015 Form 100S, California S Corporation Franchise or

Income Tax Return, and the credit carryover to future years. For more

information, see General Information Z, Passive Activity Loss Limitation;

AA, Passive Activity Credits; and BB, Tax Credits; included in this booklet.

The amount entered in column (a) must be limited to 1/3 the amount of

the total credit generated, per credit.

Schedule C (100S) 2015

7721153

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1