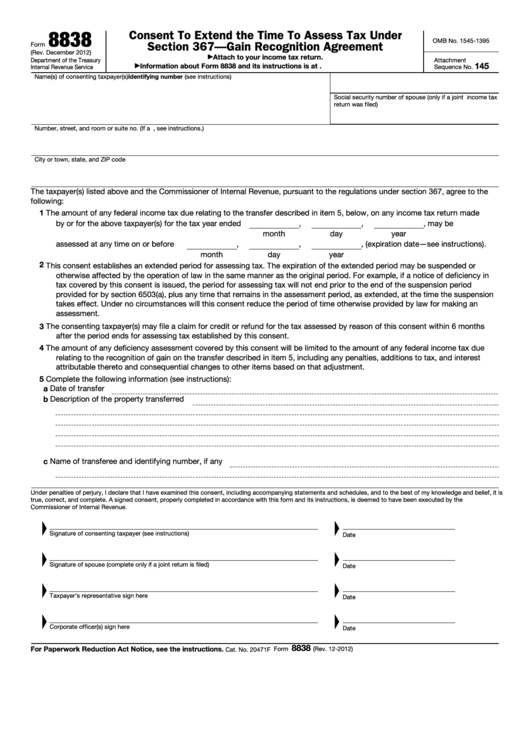

8838

Consent To Extend the Time To Assess Tax Under

OMB No. 1545-1395

Section 367—Gain Recognition Agreement

Form

(Rev. December 2012)

Attach to your income tax return.

▶

Department of the Treasury

Attachment

145

Information about Form 8838 and its instructions is at

Internal Revenue Service

▶

Sequence No.

Name(s) of consenting taxpayer(s)

Identifying number (see instructions)

Social security number of spouse (only if a joint income tax

return was filed)

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City or town, state, and ZIP code

The taxpayer(s) listed above and the Commissioner of Internal Revenue, pursuant to the regulations under section 367, agree to the

following:

1

The amount of any federal income tax due relating to the transfer described in item 5, below, on any income tax return made

by or for the above taxpayer(s) for the tax year ended

,

,

, may be

month

day

year

assessed at any time on or before

,

,

, (expiration date—see instructions).

month

day

year

2

This consent establishes an extended period for assessing tax. The expiration of the extended period may be suspended or

otherwise affected by the operation of law in the same manner as the original period. For example, if a notice of deficiency in

tax covered by this consent is issued, the period for assessing tax will not end prior to the end of the suspension period

provided for by section 6503(a), plus any time that remains in the assessment period, as extended, at the time the suspension

takes effect. Under no circumstances will this consent reduce the period of time otherwise provided by law for making an

assessment.

3

The consenting taxpayer(s) may file a claim for credit or refund for the tax assessed by reason of this consent within 6 months

after the period ends for assessing tax established by this consent.

4

The amount of any deficiency assessment covered by this consent will be limited to the amount of any federal income tax due

relating to the recognition of gain on the transfer described in item 5, including any penalties, additions to tax, and interest

attributable thereto and consequential changes to other items based on that adjustment.

5

Complete the following information (see instructions):

a Date of transfer

b Description of the property transferred

c Name of transferee and identifying number, if any

Under penalties of perjury, I declare that I have examined this consent, including accompanying statements and schedules, and to the best of my knowledge and belief, it is

true, correct, and complete. A signed consent, properly completed in accordance with this form and its instructions, is deemed to have been executed by the

Commissioner of Internal Revenue.

Signature of consenting taxpayer (see instructions)

Date

Signature of spouse (complete only if a joint return is filed)

Date

Taxpayer’s representative sign here

Date

Corporate officer(s) sign here

Date

8838

For Paperwork Reduction Act Notice, see the instructions.

Form

(Rev. 12-2012)

Cat. No. 20471F

1

1 2

2