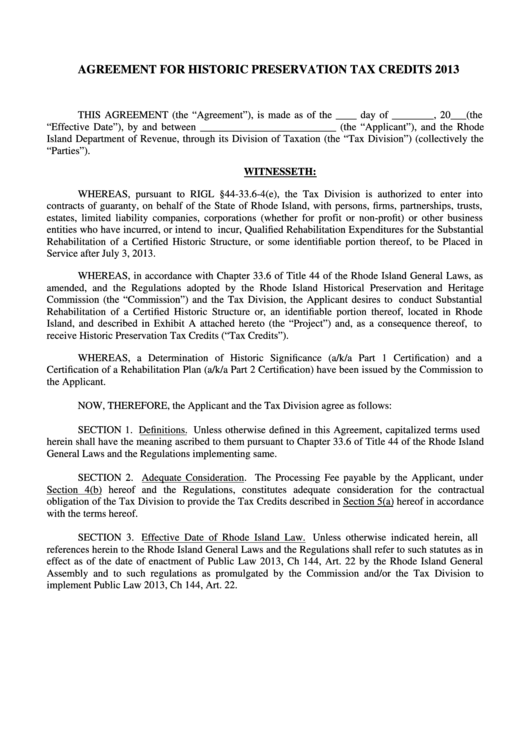

AGREEMENT FOR HISTORIC PRESERVATION TAX CREDITS 2013

THIS AGREEMENT (the “Agreement”), is made as of the ____ day of ________, 20___(the

“Effective Date”), by and between __________________________ (the “Applicant”), and the Rhode

Island Department of Revenue, through its Division of Taxation (the “Tax Division”) (collectively the

“Parties”).

WITNESSETH:

WHEREAS, pursuant to RIGL §44-33.6-4(e), the Tax Division is authorized to enter into

contracts of guaranty, on behalf of the State of Rhode Island, with persons, firms, partnerships, trusts,

estates, limited liability companies, corporations (whether for profit or non-profit) or other business

entities who have incurred, or intend to incur, Qualified Rehabilitation Expenditures for the Substantial

Rehabilitation of a Certified Historic Structure, or some identifiable portion thereof, to be Placed in

Service after July 3, 2013.

WHEREAS, in accordance with Chapter 33.6 of Title 44 of the Rhode Island General Laws, as

amended, and the Regulations adopted by the Rhode Island Historical Preservation and Heritage

Commission (the “Commission”) and the Tax Division, the Applicant desires to conduct Substantial

Rehabilitation of a Certified Historic Structure or, an identifiable portion thereof, located in Rhode

Island, and described in Exhibit A attached hereto (the “Project”) and, as a consequence thereof, to

receive Historic Preservation Tax Credits (“Tax Credits”).

WHEREAS, a Determination of Historic Significance (a/k/a Part 1 Certification) and a

Certification of a Rehabilitation Plan (a/k/a Part 2 Certification) have been issued by the Commission to

the Applicant.

NOW, THEREFORE, the Applicant and the Tax Division agree as follows:

SECTION 1. Definitions. Unless otherwise defined in this Agreement, capitalized terms used

herein shall have the meaning ascribed to them pursuant to Chapter 33.6 of Title 44 of the Rhode Island

General Laws and the Regulations implementing same.

SECTION 2. Adequate Consideration. The Processing Fee payable by the Applicant, under

Section 4(b) hereof and the Regulations, constitutes adequate consideration for the contractual

obligation of the Tax Division to provide the Tax Credits described in Section 5(a) hereof in accordance

with the terms hereof.

SECTION 3. Effective Date of Rhode Island Law. Unless otherwise indicated herein, all

references herein to the Rhode Island General Laws and the Regulations shall refer to such statutes as in

effect as of the date of enactment of Public Law 2013, Ch 144, Art. 22 by the Rhode Island General

Assembly and to such regulations as promulgated by the Commission and/or the Tax Division to

implement Public Law 2013, Ch 144, Art. 22.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14