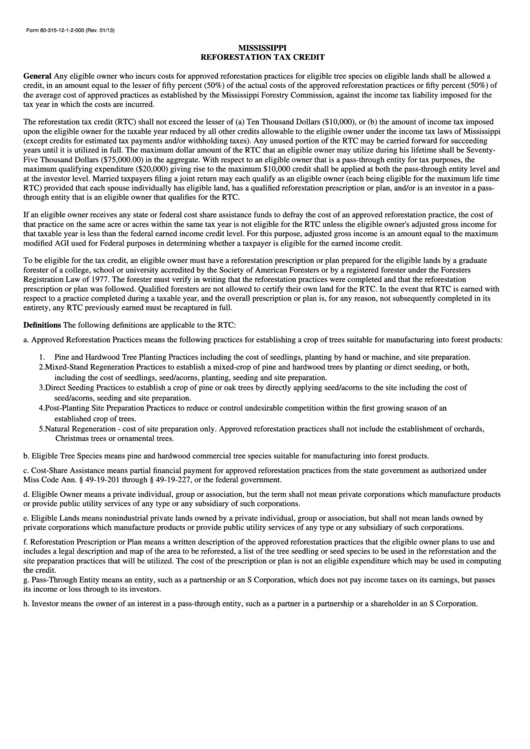

Mississippi Reforestation Tax Credit

ADVERTISEMENT

Form 80-315-12-1-2-000 (Rev. 01/13)

MISSISSIPPI

REFORESTATION TAX CREDIT

General Any eligible owner who incurs costs for approved reforestation practices for eligible tree species on eligible lands shall be allowed a

credit, in an amount equal to the lesser of fifty percent (50%) of the actual costs of the approved reforestation practices or fifty percent (50%) of

the average cost of approved practices as established by the Mississippi Forestry Commission, against the income tax liability imposed for the

tax year in which the costs are incurred.

The reforestation tax credit (RTC) shall not exceed the lesser of (a) Ten Thousand Dollars ($10,000), or (b) the amount of income tax imposed

upon the eligible owner for the taxable year reduced by all other credits allowable to the eligible owner under the income tax laws of Mississippi

(except credits for estimated tax payments and/or withholding taxes). Any unused portion of the RTC may be carried forward for succeeding

years until it is utilized in full. The maximum dollar amount of the RTC that an eligible owner may utilize during his lifetime shall be Seventy-

Five Thousand Dollars ($75,000.00) in the aggregate. With respect to an eligible owner that is a pass-through entity for tax purposes, the

maximum qualifying expenditure ($20,000) giving rise to the maximum $10,000 credit shall be applied at both the pass-through entity level and

at the investor level. Married taxpayers filing a joint return may each qualify as an eligible owner (each being eligible for the maximum life time

RTC) provided that each spouse individually has eligible land, has a qualified reforestation prescription or plan, and/or is an investor in a pass-

through entity that is an eligible owner that qualifies for the RTC.

If an eligible owner receives any state or federal cost share assistance funds to defray the cost of an approved reforestation practice, the cost of

that practice on the same acre or acres within the same tax year is not eligible for the RTC unless the eligible owner's adjusted gross income for

that taxable year is less than the federal earned income credit level. For this purpose, adjusted gross income is an amount equal to the maximum

modified AGI used for Federal purposes in determining whether a taxpayer is eligible for the earned income credit.

To be eligible for the tax credit, an eligible owner must have a reforestation prescription or plan prepared for the eligible lands by a graduate

forester of a college, school or university accredited by the Society of American Foresters or by a registered forester under the Foresters

Registration Law of 1977. The forester must verify in writing that the reforestation practices were completed and that the reforestation

prescription or plan was followed. Qualified foresters are not allowed to certify their own land for the RTC. In the event that RTC is earned with

respect to a practice completed during a taxable year, and the overall prescription or plan is, for any reason, not subsequently completed in its

entirety, any RTC previously earned must be recaptured in full.

Definitions The following definitions are applicable to the RTC:

a. Approved Reforestation Practices means the following practices for establishing a crop of trees suitable for manufacturing into forest products:

1.

Pine and Hardwood Tree Planting Practices including the cost of seedlings, planting by hand or machine, and site preparation.

2.

Mixed-Stand Regeneration Practices to establish a mixed-crop of pine and hardwood trees by planting or direct seeding, or both,

including the cost of seedlings, seed/acorns, planting, seeding and site preparation.

3.

Direct Seeding Practices to establish a crop of pine or oak trees by directly applying seed/acorns to the site including the cost of

seed/acorns, seeding and site preparation.

4.

Post-Planting Site Preparation Practices to reduce or control undesirable competition within the first growing season of an

established crop of trees.

5.

Natural Regeneration - cost of site preparation only. Approved reforestation practices shall not include the establishment of orchards,

Christmas trees or ornamental trees.

b. Eligible Tree Species means pine and hardwood commercial tree species suitable for manufacturing into forest products.

c. Cost-Share Assistance means partial financial payment for approved reforestation practices from the state government as authorized under

Miss Code Ann. § 49-19-201 through § 49-19-227, or the federal government.

d. Eligible Owner means a private individual, group or association, but the term shall not mean private corporations which manufacture products

or provide public utility services of any type or any subsidiary of such corporations.

e. Eligible Lands means nonindustrial private lands owned by a private individual, group or association, but shall not mean lands owned by

private corporations which manufacture products or provide public utility services of any type or any subsidiary of such corporations.

f. Reforestation Prescription or Plan means a written description of the approved reforestation practices that the eligible owner plans to use and

includes a legal description and map of the area to be reforested, a list of the tree seedling or seed species to be used in the reforestation and the

site preparation practices that will be utilized. The cost of the prescription or plan is not an eligible expenditure which may be used in computing

the credit.

g. Pass-Through Entity means an entity, such as a partnership or an S Corporation, which does not pay income taxes on its earnings, but passes

its income or loss through to its investors.

h. Investor means the owner of an interest in a pass-through entity, such as a partner in a partnership or a shareholder in an S Corporation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2