Print

Clear Form

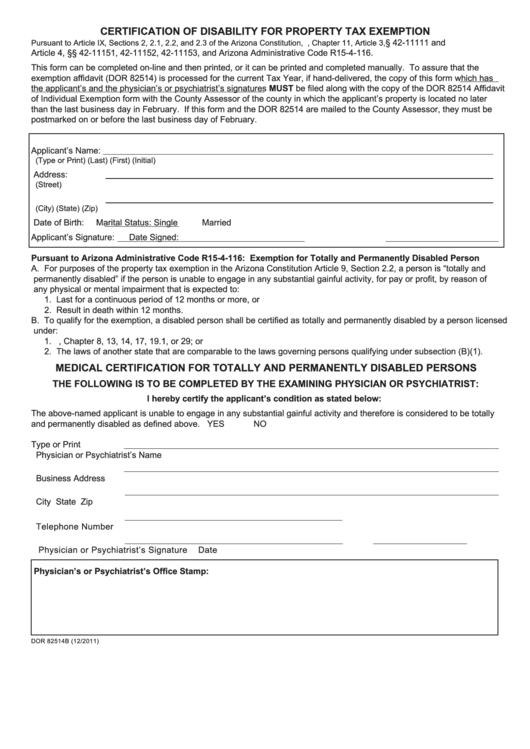

CERTIFICATION OF DISABILITY FOR PROPERTY TAX EXEMPTION

§ 42-11111 and

Pursuant to Article IX, Sections 2, 2.1, 2.2, and 2.3 of the Arizona Constitution, A.R.S. Title 42, Chapter 11, Article 3,

Article 4, §§ 42-11151, 42-11152, 42-11153, and Arizona Administrative Code R15-4-116.

This form can be completed on-line and then printed, or it can be printed and completed manually. To assure that the

exemption affidavit (DOR 82514) is processed for the current Tax Year, if hand-delivered, the copy of this form which has

the applicant’s and the physician’s or psychiatrist’s signatures MUST be filed along with the copy of the DOR 82514 Affidavit

of Individual Exemption form with the County Assessor of the county in which the applicant’s property is located no later

than the last business day in February. If this form and the DOR 82514 are mailed to the County Assessor, they must be

postmarked on or before the last business day of February.

Applicant’s Name:

(Type or Print)

(Last)

(First)

(Initial)

Address:

(Street)

(City)

(State)

(Zip)

Date of Birth:

Marital Status: Single

Married

Applicant’s Signature:

Date Signed:

Pursuant to Arizona Administrative Code R15-4-116: Exemption for Totally and Permanently Disabled Person

A. For purposes of the property tax exemption in the Arizona Constitution Article 9, Section 2.2, a person is “totally and

permanently disabled” if the person is unable to engage in any substantial gainful activity, for pay or profit, by reason of

any physical or mental impairment that is expected to:

1. Last for a continuous period of 12 months or more, or

2. Result in death within 12 months.

B. To qualify for the exemption, a disabled person shall be certified as totally and permanently disabled by a person licensed

under:

1. A.R.S. Title 32, Chapter 8, 13, 14, 17, 19.1, or 29; or

2. The laws of another state that are comparable to the laws governing persons qualifying under subsection (B)(1).

MEDICAL CERTIFICATION FOR TOTALLY AND PERMANENTLY DISABLED PERSONS

THE FOLLOWING IS TO BE COMPLETED BY THE EXAMINING PHYSICIAN OR PSYCHIATRIST:

I hereby certify the applicant’s condition as stated below:

The above-named applicant is unable to engage in any substantial gainful activity and therefore is considered to be totally

and permanently disabled as defined above. YES

NO

Type or Print

Physician or Psychiatrist’s Name

Business Address

City

State

Zip

Telephone Number

Physician or Psychiatrist’s Signature

Date

Physician’s or Psychiatrist’s Office Stamp:

DOR 82514B (12/2011)

1

1