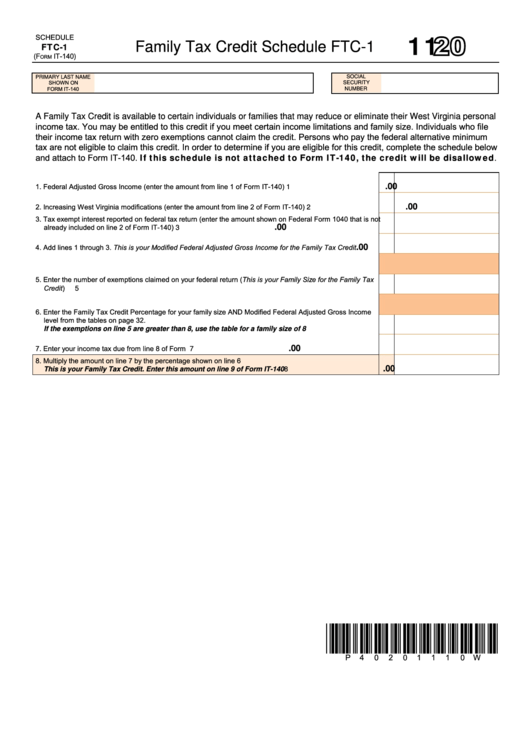

Schedule Ftc-1 (Form It-140) - West Virginia Family Tax Credit - 2011

ADVERTISEMENT

2011

SCHEDULE

FTC-1

Family Tax Credit Schedule FTC-1

IT-140)

(F

orm

SOCIAL

PRIMARY LAST NAME

SHOWN ON

SECURITY

FORM IT-140

NUMBER

A Family Tax Credit is available to certain individuals or families that may reduce or eliminate their West Virginia personal

income tax. You may be entitled to this credit if you meet certain income limitations and family size. Individuals who file

their income tax return with zero exemptions cannot claim the credit. Persons who pay the federal alternative minimum

tax are not eligible to claim this credit. In order to determine if you are eligible for this credit, complete the schedule below

and attach to Form IT-140. If this schedule is not attached to Form IT-140, the credit will be disallowed.

1. Federal Adjusted Gross Income (enter the amount from line 1 of Form IT-140).................................................

.00

1

2. Increasing West Virginia modifications (enter the amount from line 2 of Form IT-140).......................................

.00

2

3. Tax exempt interest reported on federal tax return (enter the amount shown on Federal Form 1040 that is not

already included on line 2 of Form IT-140)..............................................................................................................

.00

3

4. Add lines 1 through 3. This is your Modified Federal Adjusted Gross Income for the Family Tax Credit............

4

.00

5. Enter the number of exemptions claimed on your federal return (This is your Family Size for the Family Tax

Credit).................................................................................................................................................................

5

6. Enter the Family Tax Credit Percentage for your family size AND Modified Federal Adjusted Gross Income

level from the tables on page 32.

6

if the exemptions on line 5 are greater than 8, use the table for a family size of 8....................................

7. Enter your income tax due from line 8 of Form IT-140........................................................................................

.00

7

8. Multiply the amount on line 7 by the percentage shown on line 6

.00

this is your family tax Credit. enter this amount on line 9 of form it-140................................................

8

*p40201110W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1