Form 51a125 - Application For Purchase Exemption Sales And Use Tax

ADVERTISEMENT

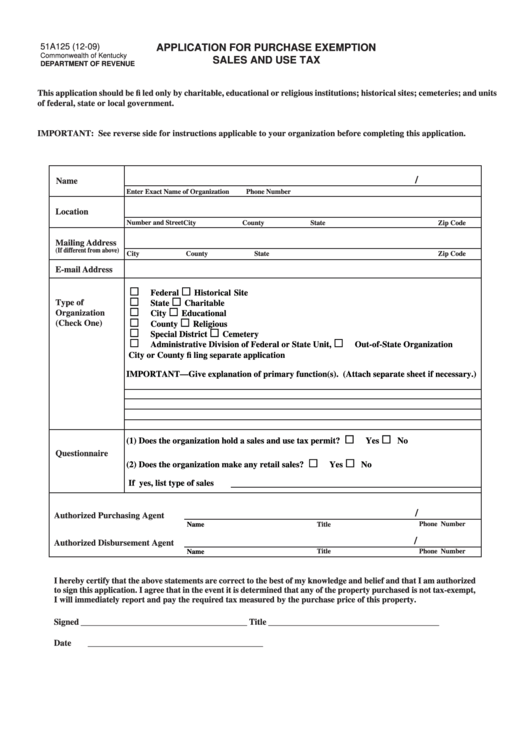

51A125 (12-09)

APPLICATION FOR PURCHASE EXEMPTION

Commonwealth of Kentucky

SALES AND USE TAX

DEPARTMENT OF REVENUE

This application should be fi led only by charitable, educational or religious institutions; historical sites; cemeteries; and units

of federal, state or local government.

IMPORTANT: See reverse side for instructions applicable to your organization before completing this application.

/

Name

Enter Exact Name of Organization

Phone Number

Location

Number and Street

City

County

State

Zip Code

Mailing Address

(If different from above)

City

County

State

Zip Code

P.O. Box or Number and Street

E-mail Address

Federal

Historical Site

Type of

State

Charitable

Organization

City

Educational

(Check One)

County

Religious

Special District

Cemetery

Administrative Division of Federal or State Unit,

Out-of-State Organization

City or County fi ling separate application

IMPORTANT—Give explanation of primary function(s). (Attach separate sheet if necessary.)

(1) Does the organization hold a sales and use tax permit?

Yes

No

Questionnaire

(2) Does the organization make any retail sales?

Yes

No

If yes, list type of sales

/

Authorized Purchasing Agent

Phone Number

Name

Title

/

Authorized Disbursement Agent

Title

Phone Number

Name

I hereby certify that the above statements are correct to the best of my knowledge and belief and that I am authorized

to sign this application. I agree that in the event it is determined that any of the property purchased is not tax-exempt,

I will immediately report and pay the required tax measured by the purchase price of this property.

Signed ______________________________________

Title _______________________________________

Date ________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2