Form St-8f - Agricultural Exemption Certificate

ADVERTISEMENT

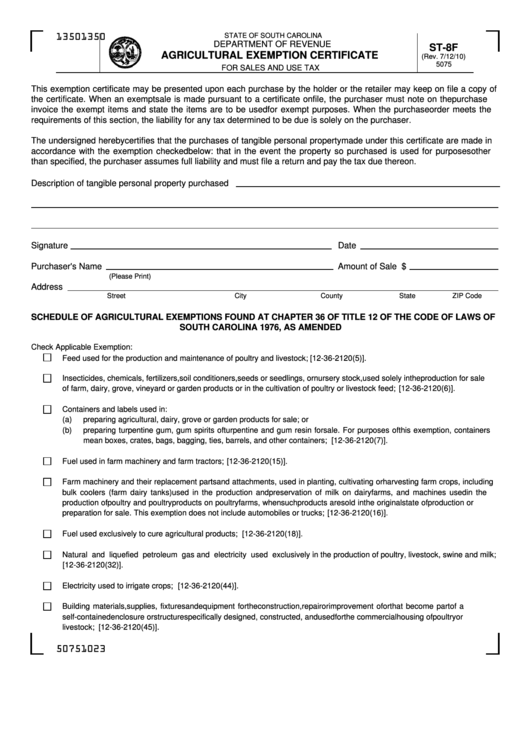

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

ST-8F

AGRICULTURAL EXEMPTION CERTIFICATE

(Rev. 7/12/10)

5075

FOR SALES AND USE TAX

This exemption certificate may be presented upon each purchase by the holder or the retailer may keep on file a copy of

the certificate. When an exempt sale is made pursuant to a certificate on file, the purchaser must note on the purchase

invoice the exempt items and state the items are to be used for exempt purposes. When the purchase order meets the

requirements of this section, the liability for any tax determined to be due is solely on the purchaser.

The undersigned hereby certifies that the purchases of tangible personal property made under this certificate are made in

accordance with the exemption checked below: that in the event the property so purchased is used for purposes other

than specified, the purchaser assumes full liability and must file a return and pay the tax due thereon.

Description of tangible personal property purchased

Signature

Date

Purchaser's Name

Amount of Sale $

(Please Print)

Address

Street

City

County

State

ZIP Code

SCHEDULE OF AGRICULTURAL EXEMPTIONS FOUND AT CHAPTER 36 OF TITLE 12 OF THE CODE OF LAWS OF

SOUTH CAROLINA 1976, AS AMENDED

Check Applicable Exemption:

Feed used for the production and maintenance of poultry and livestock;

[12-36-2120(5)].

Insecticides, chemicals, fertilizers, soil conditioners, seeds or seedlings, or nursery stock, used solely in the production for sale

of farm, dairy, grove, vineyard or garden products or in the cultivation of poultry or livestock feed;

[12-36-2120(6)].

Containers and labels used in:

(a)

preparing agricultural, dairy, grove or garden products for sale; or

(b)

preparing turpentine gum, gum spirits of turpentine and gum resin for sale. For purposes of this exemption, containers

mean boxes, crates, bags, bagging, ties, barrels, and other containers; [12-36-2120(7)].

Fuel used in farm machinery and farm tractors;

[12-36-2120(15)].

Farm machinery and their replacement parts and attachments, used in planting, cultivating or harvesting farm crops, including

bulk coolers (farm dairy tanks) used in the production and preservation of milk on dairy farms, and machines used in the

production of poultry and poultry products on poultry farms, when such products are sold in the original state of production or

preparation for sale. This exemption does not include automobiles or trucks;

[12-36-2120(16)].

Fuel used exclusively to cure agricultural products;

[12-36-2120(18)].

Natural and liquefied petroleum gas and electricity used exclusively in the production of poultry, livestock, swine and milk;

[12-36-2120(32)].

Electricity used to irrigate crops;

[12-36-2120(44)].

Building materials, supplies, fixtures and equipment for the construction, repair or improvement of or that become part of a

self-contained enclosure or structure specifically designed, constructed, and used for the commercial housing of poultry or

livestock;

[12-36-2120(45)].

50751023

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1