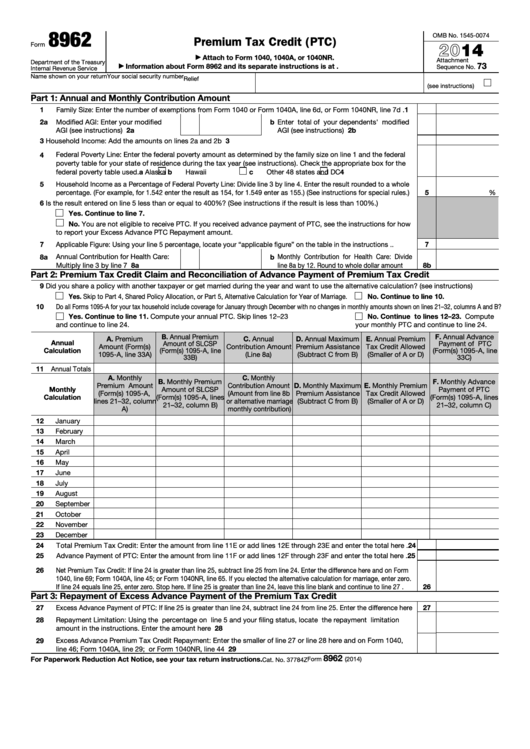

8962

OMB No. 1545-0074

Premium Tax Credit (PTC)

2014

Form

Attach to Form 1040, 1040A, or 1040NR.

▶

Attachment

Department of the Treasury

73

Information about Form 8962 and its separate instructions is at

▶

Sequence No.

Internal Revenue Service

Name shown on your return

Your social security number

Relief

(see instructions)

Part 1: Annual and Monthly Contribution Amount

1

Family Size: Enter the number of exemptions from Form 1040 or Form 1040A, line 6d, or Form 1040NR, line 7d .

1

2 a

Modified AGI: Enter your modified

b Enter total of your dependents' modified

2a

2b

AGI (see instructions) .

.

.

.

.

AGI (see instructions)

.

.

.

.

.

.

3

3

Household Income: Add the amounts on lines 2a and 2b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Federal Poverty Line: Enter the federal poverty amount as determined by the family size on line 1 and the federal

4

poverty table for your state of residence during the tax year (see instructions). Check the appropriate box for the

federal poverty table used.

a

Alaska

b

Hawaii

c

Other 48 states and DC

4

5

Household Income as a Percentage of Federal Poverty Line: Divide line 3 by line 4. Enter the result rounded to a whole

5

percentage. (For example, for 1.542 enter the result as 154, for 1.549 enter as 155.) (See instructions for special rules.)

%

6

Is the result entered on line 5 less than or equal to 400%? (See instructions if the result is less than 100%.)

Yes. Continue to line 7.

No. You are not eligible to receive PTC. If you received advance payment of PTC, see the instructions for how

to report your Excess Advance PTC Repayment amount.

7

7

Applicable Figure: Using your line 5 percentage, locate your “applicable figure” on the table in the instructions

.

.

8 a

Annual Contribution for Health Care:

b Monthly Contribution for Health Care: Divide

Multiply line 3 by line 7

.

.

.

.

8a

line 8a by 12. Round to whole dollar amount

8b

Part 2: Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit

9

Did you share a policy with another taxpayer or get married during the year and want to use the alternative calculation? (see instructions)

Yes. Skip to Part 4, Shared Policy Allocation, or Part 5, Alternative Calculation for Year of Marriage.

No. Continue to line 10.

10

Do all Forms 1095-A for your tax household include coverage for January through December with no changes in monthly amounts shown on lines 21–32, columns A and B?

Yes. Continue to line 11. Compute your annual PTC. Skip lines 12–23

No. Continue to lines 12–23. Compute

and continue to line 24.

your monthly PTC and continue to line 24.

B. Annual Premium

F. Annual Advance

A. Premium

C. Annual

D. Annual Maximum

E. Annual Premium

Annual

Amount of SLCSP

Payment of PTC

Amount (Form(s)

Contribution Amount

Premium Assistance

Tax Credit Allowed

Calculation

(Form(s) 1095-A, line

(Form(s) 1095-A, line

1095-A, line 33A)

(Line 8a)

(Subtract C from B)

(Smaller of A or D)

33B)

33C)

11

Annual Totals

A. Monthly

C. Monthly

B. Monthly Premium

F. Monthly Advance

Premium Amount

Contribution Amount

D. Monthly Maximum

E. Monthly Premium

Monthly

Amount of SLCSP

Payment of PTC

(Form(s) 1095-A,

(Amount from line 8b

Premium Assistance

Tax Credit Allowed

Calculation

(Form(s) 1095-A, lines

(Form(s) 1095-A, lines

lines 21–32, column

or alternative marriage

(Subtract C from B)

(Smaller of A or D)

21–32, column B)

21–32, column C)

A)

monthly contribution)

12

January

13

February

14

March

15

April

16

May

17

June

18

July

19

August

20

September

21

October

22

November

23

December

24

Total Premium Tax Credit: Enter the amount from line 11E or add lines 12E through 23E and enter the total here .

24

25

Advance Payment of PTC: Enter the amount from line 11F or add lines 12F through 23F and enter the total here .

25

26

Net Premium Tax Credit: If line 24 is greater than line 25, subtract line 25 from line 24. Enter the difference here and on Form

1040, line 69; Form 1040A, line 45; or Form 1040NR, line 65. If you elected the alternative calculation for marriage, enter zero.

26

If line 24 equals line 25, enter zero. Stop here. If line 25 is greater than line 24, leave this line blank and continue to line 27

.

Part 3: Repayment of Excess Advance Payment of the Premium Tax Credit

27

Excess Advance Payment of PTC: If line 25 is greater than line 24, subtract line 24 from line 25. Enter the difference here

27

Repayment Limitation: Using the percentage on line 5 and your filing status, locate the repayment limitation

28

amount in the instructions. Enter the amount here

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

28

29

Excess Advance Premium Tax Credit Repayment: Enter the smaller of line 27 or line 28 here and on Form 1040,

29

line 46; Form 1040A, line 29; or Form 1040NR, line 44 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8962

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2014)

Cat. No. 37784Z

1

1 2

2