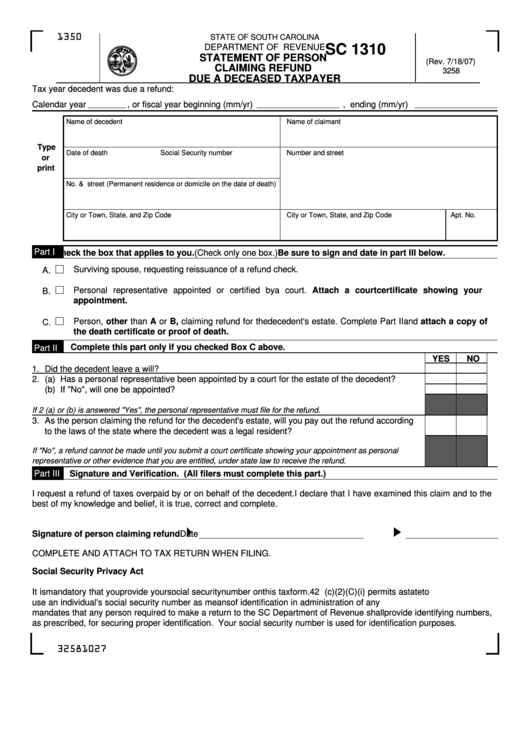

Form Sc 1310 - South Carolina Statement Of Person Claiming Refund Due A Deceased Taxpayer

ADVERTISEMENT

1350

STATE OF SOUTH CAROLINA

SC 1310

DEPARTMENT OF REVENUE

STATEMENT OF PERSON

(Rev. 7/18/07)

CLAIMING REFUND

3258

DUE A DECEASED TAXPAYER

Tax year decedent was due a refund:

Calendar year

, or fiscal year beginning (mm/yr)

, ending (mm/yr)

Name of decedent

Name of claimant

Type

Date of death

Social Security number

Number and street

or

print

No. & street (Permanent residence or domicile on the date of death)

City or Town, State, and Zip Code

City or Town, State, and Zip Code

Apt. No.

Part I

Check the box that applies to you. (Check only one box.) Be sure to sign and date in part III below.

Surviving spouse, requesting reissuance of a refund check.

A.

Personal representative appointed or certified by a court. Attach a court certificate showing your

B.

appointment.

Person, other than A or B, claiming refund for the decedent's estate. Complete Part II and attach a copy of

C.

the death certificate or proof of death.

Complete this part only if you checked Box C above.

Part II

YES

NO

1.

Did the decedent leave a will? .........................................................................................................

2.

(a)

Has a personal representative been appointed by a court for the estate of the decedent? .....

(b)

If "No", will one be appointed? ...................................................................................................

If 2 (a) or (b) is answered "Yes", the personal representative must file for the refund.

3.

As the person claiming the refund for the decedent's estate, will you pay out the refund according

to the laws of the state where the decedent was a legal resident? ..................................................

If "No", a refund cannot be made until you submit a court certificate showing your appointment as personal

representative or other evidence that you are entitled, under state law to receive the refund.

Part III

Signature and Verification. (All filers must complete this part.)

I request a refund of taxes overpaid by or on behalf of the decedent. I declare that I have examined this claim and to the

best of my knowledge and belief, it is true, correct and complete.

Signature of person claiming refund

Date

COMPLETE AND ATTACH TO TAX RETURN WHEN FILING.

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to

use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201

mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers,

as prescribed, for securing proper identification. Your social security number is used for identification purposes.

32581027

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1