Clear Form

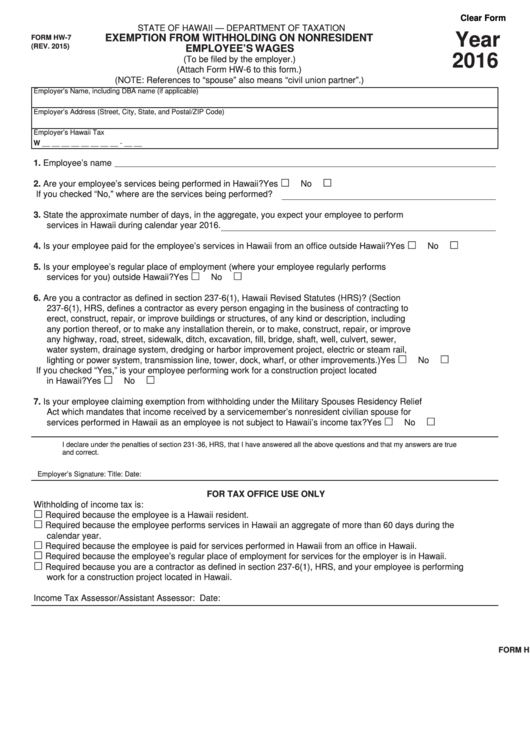

STATE OF HAWAII — DEPARTMENT OF TAXATION

Year

EXEMPTION FROM WITHHOLDING ON NONRESIDENT

FORM HW-7

(REV. 2015)

EMPLOYEE’S WAGES

2016

(To be filed by the employer.)

(Attach Form HW-6 to this form.)

(NOTE: References to “spouse” also means “civil union partner”.)

Employer’s Name, including DBA name (if applicable)

Employer’s Address (Street, City, State, and Postal/ZIP Code)

Employer’s Hawaii Tax I.D. No.

W __ __ __ __ __ __ __ __ - __ __

1. Employee’s name

2. Are your employee’s services being performed in Hawaii? ......................................................................Yes

No

If you checked “No,” where are the services being performed?

3. State the approximate number of days, in the aggregate, you expect your employee to perform

services in Hawaii during calendar year 2016.

4. Is your employee paid for the employee’s services in Hawaii from an office outside Hawaii? .................Yes

No

5. Is your employee’s regular place of employment (where your employee regularly performs

services for you) outside Hawaii? ............................................................................................................Yes

No

6. Are you a contractor as defined in section 237-6(1), Hawaii Revised Statutes (HRS)? (Section

237-6(1), HRS, defines a contractor as every person engaging in the business of contracting to

erect, construct, repair, or improve buildings or structures, of any kind or description, including

any portion thereof, or to make any installation therein, or to make, construct, repair, or improve

any highway, road, street, sidewalk, ditch, excavation, fill, bridge, shaft, well, culvert, sewer,

water system, drainage system, dredging or harbor improvement project, electric or steam rail,

lighting or power system, transmission line, tower, dock, wharf, or other improvements.) .......................Yes

No

If you checked “Yes,” is your employee performing work for a construction project located

in Hawaii? .................................................................................................................................................Yes

No

7. Is your employee claiming exemption from withholding under the Military Spouses Residency Relief

Act which mandates that income received by a servicemember’s nonresident civilian spouse for

services performed in Hawaii as an employee is not subject to Hawaii’s income tax? ............................Yes

No

I declare under the penalties of section 231-36, HRS, that I have answered all the above questions and that my answers are true

and correct.

Employer’s Signature:

Title:

Date:

FOR TAX OFFICE USE ONLY

Withholding of income tax is:

Required because the employee is a Hawaii resident.

Required because the employee performs services in Hawaii an aggregate of more than 60 days during the

calendar year.

Required because the employee is paid for services performed in Hawaii from an office in Hawaii.

Required because the employee’s regular place of employment for services for the employer is in Hawaii.

Required because you are a contractor as defined in section 237-6(1), HRS, and your employee is performing

work for a construction project located in Hawaii.

Income Tax Assessor/Assistant Assessor:

Date:

FORM HW-7

1

1 2

2