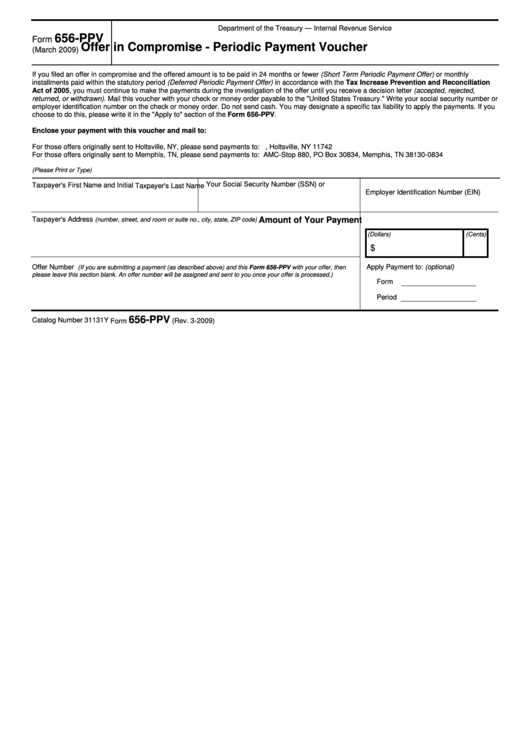

Department of the Treasury — Internal Revenue Service

656-PPV

Form

Offer in Compromise - Periodic Payment Voucher

(March 2009)

If you filed an offer in compromise and the offered amount is to be paid in 24 months or fewer (Short Term Periodic Payment Offer) or monthly

installments paid within the statutory period (Deferred Periodic Payment Offer) in accordance with the Tax Increase Prevention and Reconciliation

Act of 2005, you must continue to make the payments during the investigation of the offer until you receive a decision letter (accepted, rejected,

returned, or withdrawn). Mail this voucher with your check or money order payable to the "United States Treasury." Write your social security number or

employer identification number on the check or money order. Do not send cash. You may designate a specific tax liability to apply the payments. If you

choose to do this, please write it in the "Apply to" section of the Form 656-PPV.

Enclose your payment with this voucher and mail to:

For those offers originally sent to Holtsville, NY, please send payments to: P.O. Box 9011, Holtsville, NY 11742

For those offers originally sent to Memphis, TN, please send payments to: AMC-Stop 880, PO Box 30834, Memphis, TN 38130-0834

(Please Print or Type)

Your Social Security Number (SSN) or

Taxpayer's First Name and Initial

Taxpayer's Last Name

Employer Identification Number (EIN)

Taxpayer's Address

Amount of Your Payment

(number, street, and room or suite no., city, state, ZIP code)

(Dollars)

(Cents)

$

Apply Payment to: (optional)

Offer Number

(If you are submitting a payment (as described above) and this Form 656-PPV with your offer, then

please leave this section blank. An offer number will be assigned and sent to you once your offer is processed.)

Form

Period

656-PPV

Catalog Number 31131Y

Form

(Rev. 3-2009)

1

1