RESET

PRINT

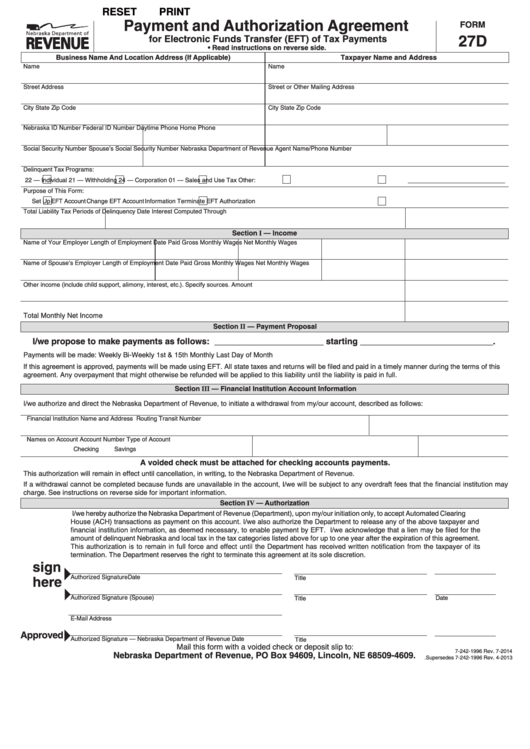

Payment and Authorization Agreement

FORM

27D

for Electronic Funds Transfer (EFT) of Tax Payments

• Read instructions on reverse side.

Business Name And Location Address (If Applicable)

Taxpayer Name and Address

Name

Name

Street Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Nebraska ID Number

Federal ID Number

Daytime Phone

Home Phone

Social Security Number

Spouse’s Social Security Number

Nebraska Department of Revenue Agent Name/Phone Number

Delinquent Tax Programs:

22 — Individual

21 — Withholding

24 — Corporation

01 — Sales and Use Tax

Other:

Purpose of This Form:

Set Up EFT Account

Change EFT Account Information

Terminate EFT Authorization

Total Liability

Tax Periods of Delinquency

Date Interest Computed Through

Section I — Income

Name of Your Employer

Length of Employment

Date Paid

Gross Monthly Wages

Net Monthly Wages

Name of Spouse’s Employer

Length of Employment

Date Paid

Gross Monthly Wages

Net Monthly Wages

Other income (include child support, alimony, interest, etc.). Specify sources.

Amount

Total Monthly Net Income ...........................................................................................................................................................

Section II — Payment Proposal

I/we propose to make payments as follows: _______________________ starting ____________________________.

Payments will be made:

Weekly

Bi-Weekly

1st & 15th

Monthly

Last Day of Month

If this agreement is approved, payments will be made using EFT. All state taxes and returns will be filed and paid in a timely manner during the terms of this

agreement. Any overpayment that might otherwise be refunded will be applied to this liability until the liability is paid in full.

Section III — Financial Institution Account Information

I/we authorize and direct the Nebraska Department of Revenue, to initiate a withdrawal from my/our account, described as follows:

Financial Institution Name and Address

Routing Transit Number

Names on Account

Account Number

Type of Account

Checking

Savings

A voided check must be attached for checking accounts payments.

This authorization will remain in effect until cancellation, in writing, to the Nebraska Department of Revenue.

If a withdrawal cannot be completed because funds are unavailable in the account, I/we will be subject to any overdraft fees that the financial institution may

charge. See instructions on reverse side for important information.

Section IV — Authorization

I/we hereby authorize the Nebraska Department of Revenue (Department), upon my/our initiation only, to accept Automated Clearing

House (ACH) transactions as payment on this account. I/we also authorize the Department to release any of the above taxpayer and

financial institution information, as deemed necessary, to enable payment by EFT. I/we acknowledge that a lien may be filed for the

amount of delinquent Nebraska and local tax in the tax categories listed above for up to one year after the expiration of this agreement.

This authorization is to remain in full force and effect until the Department has received written notification from the taxpayer of its

termination. The Department reserves the right to terminate this agreement at its sole discretion.

sign

here

Authorized Signature

Date

Title

Authorized Signature (Spouse)

Date

Title

E-Mail Address

Approved

Authorized Signature — Nebraska Department of Revenue

Date

Title

Mail this form with a voided check or deposit slip to:

7-242-1996 Rev. 7-2014

Nebraska Department of Revenue, PO Box 94609, Lincoln, NE 68509-4609.

.Supersedes 7-242-1996 Rev. 4-2013

1

1 2

2