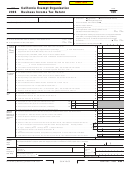

Schedule A Cost of Goods Sold and/or Operations.

Method of inventory valuation (specify) _______________________________________________

00

1 Inventory at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Cost of labor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 a Additional IRC Section 263A costs. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

00

b Other costs. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4b

00

5 Total. Add line 1 through line 4b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Cost of goods sold and/or operations. Subtract line 6 from line 5. Enter here and on Side 2, Part I, line 2 . . . . . . . . . . . . .

7

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to this organization? Yes No

Schedule B Tax Credits. Do not claim the New Jobs Credit on Schedule B.

00

1 Enter credit name__________________________code

__________. . . . . . .

1

00

2 Enter credit name__________________________code

__________. . . . . . .

2

00

3 Enter credit name__________________________code

__________. . . . . . .

3

4 Total. Add line 1 through line 3. If claiming more than 3 credits, enter the total of all claimed credits,

00

except New Jobs Credit, on line 4. Enter here and on Side 1, line 11c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Schedule K Add-On Taxes or Recapture of Tax. See instructions.

00

1

Interest computation under the look-back method for completed long-term contracts. Attach form FTB 3834 . . . . . . . .

1

2

Interest on tax attributable to installment: a Sales of certain timeshares or residential lots. . . . . . . . . . . . . . . . . . . . .

2a

00

00

b Method for non-dealer installment obligations . . . . . . . . . . . . . . . . . . . .

2b

00

3

IRC Section 197(f)(9)(B)(ii) election to recognize gain on the disposition of intangibles. . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Credit recapture. Credit name___________________________________________. . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

00

5

Total. Combine the amounts on line 1 through line 4. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Schedule R Apportionment Formula Worksheet. Use only for unrelated trade or business amounts.

Part A. Standard Method – Single-Sales Factor Formula. Complete this part only if the corporation uses the single-sales factor formula.

(a)

(b)

(c)

Total within and

Total within

Percent within

outside California

California

California [(b) ÷ (a)] x 100

1

Total Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Apportionment percentage. Divide total sales column (b) by total sales column (a) and

multiply the result by 100. Enter the result here and on Form 109, Side 1, line 2. . . . . . . .

Part B. Three Factor Formula. Complete this part only if the corporation uses the three-factor formula.

(a)

(b)

(c)

Total within and

Total within

Percent within

outside California

California

California [(b) ÷ (a)] x 100

1

Property factor: See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Payroll factor: Wages and other compensation of employees . . . . . . . . . . . . . . . . . . . . . . .

3

Sales factor: Gross sales and/or receipts less returns and allowances . . . . . . . . . . . . . . . .

4

Total percentage: Add the percentages in column (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Average apportionment percentage: Divide the factor on line 4 by 3 and enter the

result here and on Form 109, Side 1, line 2. See instructions for exceptions

Schedule C Rental Income from Real Property and Personal Property Leased with Real Property

For rental income from debt-financed property, use Schedule D, R&TC Section 23701g, Section 23701i, and Section 23701n organizations. See instructions for exceptions.

1 Description of property

2 Rent received

3 Percentage of rent attributable

or accrued

to personal property

%

%

%

4 Complete if any item in column 3 is more than 50%, or for any item

5 Complete if any item in column 3 is more than 10%, but not more than 50%

if the rent is determined on the basis of profit or income

(a) Deductions directly connected

(b) Income includible, column 2

(a) Gross income reportable,

(b) Deductions directly connected with

(c) Net income includible, column 5(a)

(attach schedule)

less column 4(a)

column 2 x column 3

personal property (attach schedule)

less column 5(b)

Add columns 4(b) and column 5(c). Enter here and on Side 2, Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 109

2013 Side 3

C1

3643133

1

1 2

2 3

3 4

4 5

5