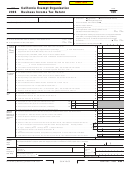

Schedule H Advertising Income and Excess Advertising Costs

Part I Income from Periodicals Reported on a Consolidated Basis

1 Name of periodical

2 Gross

3 Direct

4 Advertising income

5 Circulation

6 Readership

7 If column 5 is greater than

advertising

advertising

or excess advertising

income

costs

column 6, enter the income

income

costs

costs. If column 2 is

shown in column 4, in

greater than column 3,

Part III, column A(b). If

complete columns 5,

column 6 is greater than

6, and 7. If column 3

column 5, subtract the sum

is greater than

of column 6 and column 3

column 2, enter the

from the sum of column 5

excess in Part III,

and column 2. Enter amount

column B(b). Do not

in Part III, column A(b). If the

complete columns 5,

amount is less than zero,

6, and 7.

enter -0-.

Totals . . . . . . . . . . . . . . . . . . .

Part II Income from Periodicals Reported on a Separate Basis

Part III Column A – Net Advertising Income

Part III Column B – Excess Advertising Costs

(a) Enter “consolidated periodical” and/or

(b) Enter total amount from Part I, column 4 or

(a) Enter “consolidated periodical” and/or

(b) Enter total amount from Part I, column 4,

names of non-consolidated periodicals

7, and amounts listed in Part II, cols. 4 and 7

names of non-consolidated periodicals

and amounts listed in Part II, column 4

Enter total here and on Side 2, Part I, line 11

Enter total here and on Side 2, Part II, line 27

Schedule I Compensation of Officers, Directors, and Trustees

1 Name of Officer

2 SSN or ITIN

3 Title

4 Percent of time devoted

5 Compensation attributable

6 Expense account allowances

to business

to unrelated business

%

%

%

%

%

Total. Enter here and on Side 2, Part II, line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule J Depreciation (Corporations and Associations only. Trusts use form FTB 3885F.)

1 Group and guideline class or description

2 Date acquired (DD/MM/YYYY)

3 Cost or other basis

4 Depreciation allowed

5 Method of computing

6 Life or rate

7 Depreciation for

of property

or allowable in prior

depreciation

this year

years

1

Total additional first-year depreciation (do not include in items below) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Other depreciation:

Buildings . . . . . . . . . . . . . . . . . . . .

Furniture and fixtures . . . . . . . . . . .

Transportation equipment . . . . . . .

Machinery and other equipment. . .

Other (specify)________________

___________________________

3

Other depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Amount of depreciation claimed elsewhere on return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Balance. Subtract line 5 from line 4. Enter here and on Side 2, Part II, line 21a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 109

2013 Side 5

C1

3645133

1

1 2

2 3

3 4

4 5

5