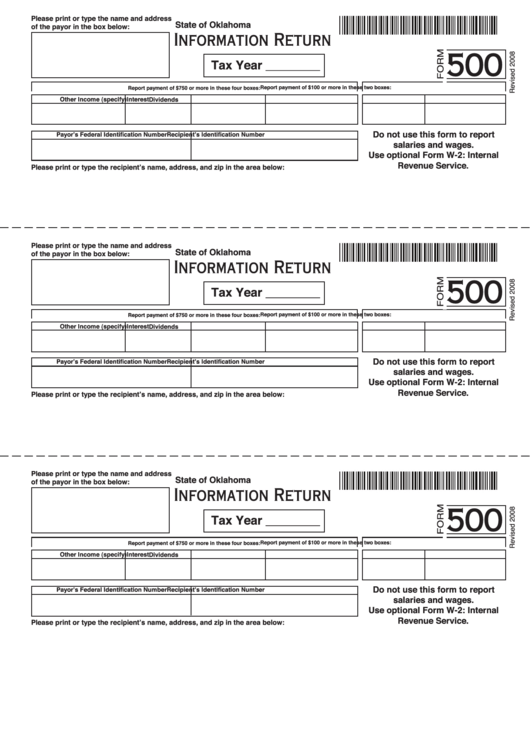

Please print or type the name and address

State of Oklahoma

of the payor in the box below:

Information Return

500

Tax Year ________

Report payment of $100 or more in these two boxes:

Report payment of $750 or more in these four boxes:

Commission

N.E.C. Payments

Rents

Other Income (specify)

Interest

Dividends

Do not use this form to report

Payor’s Federal Identification Number

Recipient’s Identification Number

salaries and wages.

Use optional Form W-2: Internal

Revenue Service.

Please print or type the recipient’s name, address, and zip in the area below:

Please print or type the name and address

State of Oklahoma

of the payor in the box below:

Information Return

500

Tax Year ________

Report payment of $100 or more in these two boxes:

Report payment of $750 or more in these four boxes:

Commission

N.E.C. Payments

Rents

Other Income (specify)

Interest

Dividends

Do not use this form to report

Payor’s Federal Identification Number

Recipient’s Identification Number

salaries and wages.

Use optional Form W-2: Internal

Revenue Service.

Please print or type the recipient’s name, address, and zip in the area below:

Please print or type the name and address

State of Oklahoma

of the payor in the box below:

Information Return

500

Tax Year ________

Report payment of $100 or more in these two boxes:

Report payment of $750 or more in these four boxes:

Commission

N.E.C. Payments

Rents

Other Income (specify)

Interest

Dividends

Do not use this form to report

Payor’s Federal Identification Number

Recipient’s Identification Number

salaries and wages.

Use optional Form W-2: Internal

Revenue Service.

Please print or type the recipient’s name, address, and zip in the area below:

1

1