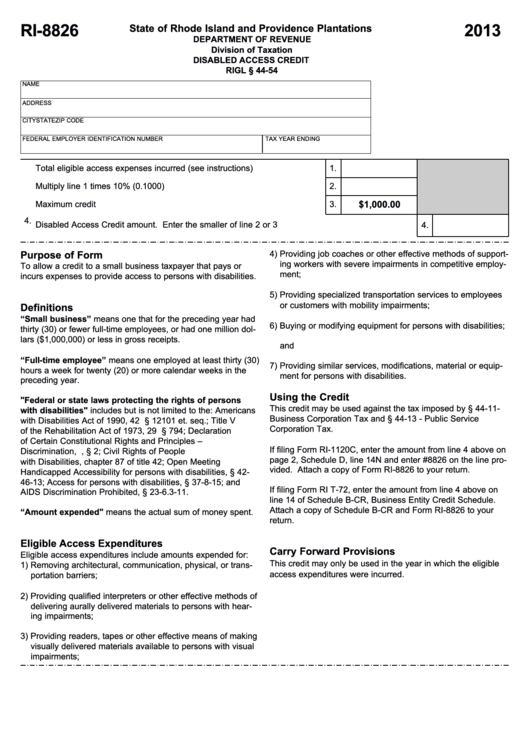

RI-8826

2013

State of Rhode Island and Providence Plantations

DEPARTMENT OF REVENUE

Division of Taxation

DISABLED ACCESS CREDIT

RIGL § 44-54

NAME

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

TAX YEAR ENDING

1.

Total eligible access expenses incurred (see instructions)...............................

1.

2.

Multiply line 1 times 10% (0.1000)....................................................................

2.

3.

Maximum credit amount....................................................................................

3.

$1,000.00

4.

Disabled Access Credit amount. Enter the smaller of line 2 or 3 here..................................................

4.

Purpose of Form

4) Providing job coaches or other effective methods of support-

ing workers with severe impairments in competitive employ-

To allow a credit to a small business taxpayer that pays or

ment;

incurs expenses to provide access to persons with disabilities.

5) Providing specialized transportation services to employees

or customers with mobility impairments;

Definitions

“Small business” means one that for the preceding year had

6) Buying or modifying equipment for persons with disabilities;

thirty (30) or fewer full-time employees, or had one million dol-

lars ($1,000,000) or less in gross receipts.

and

“Full-time employee” means one employed at least thirty (30)

7) Providing similar services, modifications, material or equip-

hours a week for twenty (20) or more calendar weeks in the

ment for persons with disabilities.

preceding year.

Using the Credit

"Federal or state laws protecting the rights of persons

This credit may be used against the tax imposed by § 44-11-

with disabilities" includes but is not limited to the: Americans

Business Corporation Tax and § 44-13 - Public Service

with Disabilities Act of 1990, 42 U.S.C. § 12101 et. seq.; Title V

Corporation Tax.

of the Rehabilitation Act of 1973, 29 U.S.C. § 794; Declaration

of Certain Constitutional Rights and Principles –

If filing Form RI-1120C, enter the amount from line 4 above on

Discrimination, R.I. Const. art. 1, § 2; Civil Rights of People

page 2, Schedule D, line 14N and enter #8826 on the line pro-

with Disabilities, chapter 87 of title 42; Open Meeting

vided. Attach a copy of Form RI-8826 to your return.

Handicapped Accessibility for persons with disabilities, § 42-

46-13; Access for persons with disabilities, § 37-8-15; and

If filing Form RI T-72, enter the amount from line 4 above on

AIDS Discrimination Prohibited, § 23-6.3-11.

line 14 of Schedule B-CR, Business Entity Credit Schedule.

Attach a copy of Schedule B-CR and Form RI-8826 to your

“Amount expended" means the actual sum of money spent.

return.

Eligible Access Expenditures

Carry Forward Provisions

Eligible access expenditures include amounts expended for:

This credit may only be used in the year in which the eligible

1) Removing architectural, communication, physical, or trans-

access expenditures were incurred.

portation barriers;

2) Providing qualified interpreters or other effective methods of

delivering aurally delivered materials to persons with hear-

ing impairments;

3) Providing readers, tapes or other effective means of making

visually delivered materials available to persons with visual

impairments;

1

1