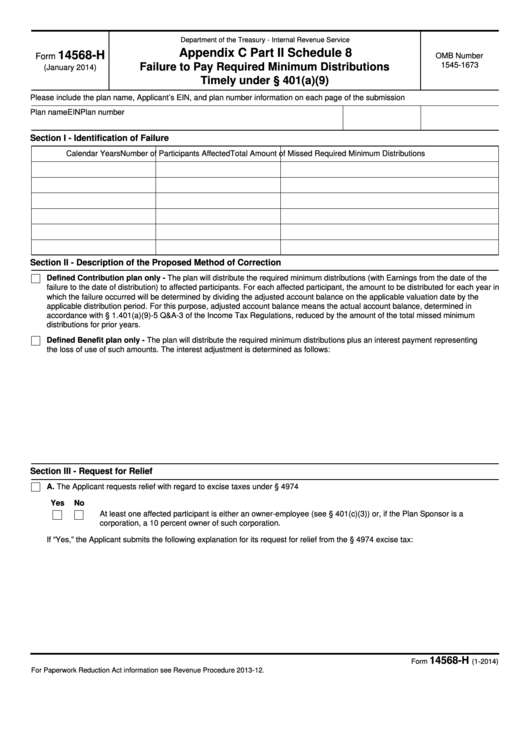

Department of the Treasury - Internal Revenue Service

Appendix C Part II Schedule 8

14568-H

Form

OMB Number

1545-1673

Failure to Pay Required Minimum Distributions

(January 2014)

Timely under § 401(a)(9)

Please include the plan name, Applicant’s EIN, and plan number information on each page of the submission

Plan name

EIN

Plan number

Section I - Identification of Failure

Calendar Years

Number of Participants Affected

Total Amount of Missed Required Minimum Distributions

Section II - Description of the Proposed Method of Correction

Defined Contribution plan only - The plan will distribute the required minimum distributions (with Earnings from the date of the

failure to the date of distribution) to affected participants. For each affected participant, the amount to be distributed for each year in

which the failure occurred will be determined by dividing the adjusted account balance on the applicable valuation date by the

applicable distribution period. For this purpose, adjusted account balance means the actual account balance, determined in

accordance with § 1.401(a)(9)-5 Q&A-3 of the Income Tax Regulations, reduced by the amount of the total missed minimum

distributions for prior years.

Defined Benefit plan only - The plan will distribute the required minimum distributions plus an interest payment representing

the loss of use of such amounts. The interest adjustment is determined as follows:

Section III - Request for Relief

A. The Applicant requests relief with regard to excise taxes under § 4974

Yes

No

At least one affected participant is either an owner-employee (see § 401(c)(3)) or, if the Plan Sponsor is a

corporation, a 10 percent owner of such corporation.

If “Yes,” the Applicant submits the following explanation for its request for relief from the § 4974 excise tax:

14568-H

Catalog Number 66153Y

Form

(1-2014)

For Paperwork Reduction Act information see Revenue Procedure 2013-12.

1

1 2

2