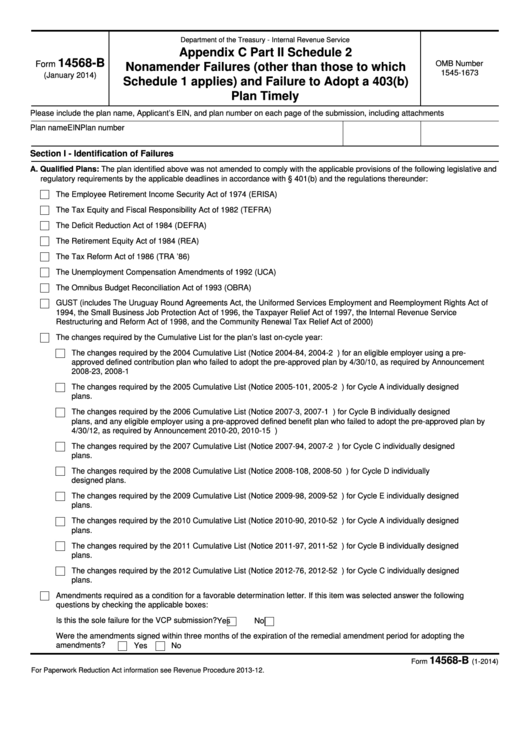

Department of the Treasury - Internal Revenue Service

Appendix C Part II Schedule 2

14568-B

OMB Number

Form

Nonamender Failures (other than those to which

1545-1673

(January 2014)

Schedule 1 applies) and Failure to Adopt a 403(b)

Plan Timely

Please include the plan name, Applicant’s EIN, and plan number on each page of the submission, including attachments

Plan name

EIN

Plan number

Section I - Identification of Failures

A. Qualified Plans: The plan identified above was not amended to comply with the applicable provisions of the following legislative and

regulatory requirements by the applicable deadlines in accordance with § 401(b) and the regulations thereunder:

The Employee Retirement Income Security Act of 1974 (ERISA)

The Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA)

The Deficit Reduction Act of 1984 (DEFRA)

The Retirement Equity Act of 1984 (REA)

The Tax Reform Act of 1986 (TRA ’86)

The Unemployment Compensation Amendments of 1992 (UCA)

The Omnibus Budget Reconciliation Act of 1993 (OBRA)

GUST (includes The Uruguay Round Agreements Act, the Uniformed Services Employment and Reemployment Rights Act of

1994, the Small Business Job Protection Act of 1996, the Taxpayer Relief Act of 1997, the Internal Revenue Service

Restructuring and Reform Act of 1998, and the Community Renewal Tax Relief Act of 2000)

The changes required by the Cumulative List for the plan’s last on-cycle year:

The changes required by the 2004 Cumulative List (Notice 2004-84, 2004-2 C.B. 1030) for an eligible employer using a pre-

approved defined contribution plan who failed to adopt the pre-approved plan by 4/30/10, as required by Announcement

2008-23, 2008-1 C.B. 731.

The changes required by the 2005 Cumulative List (Notice 2005-101, 2005-2 C.B. 1219) for Cycle A individually designed

plans.

The changes required by the 2006 Cumulative List (Notice 2007-3, 2007-1 C.B. 255) for Cycle B individually designed

plans, and any eligible employer using a pre-approved defined benefit plan who failed to adopt the pre-approved plan by

4/30/12, as required by Announcement 2010-20, 2010-15 I.R.B. 551.)

The changes required by the 2007 Cumulative List (Notice 2007-94, 2007-2 C.B. 1179) for Cycle C individually designed

plans.

The changes required by the 2008 Cumulative List (Notice 2008-108, 2008-50 I.R.B. 1275) for Cycle D individually

designed plans.

The changes required by the 2009 Cumulative List (Notice 2009-98, 2009-52 I.R.B. 974) for Cycle E individually designed

plans.

The changes required by the 2010 Cumulative List (Notice 2010-90, 2010-52 I.R.B. 909) for Cycle A individually designed

plans.

The changes required by the 2011 Cumulative List (Notice 2011-97, 2011-52 I.R.B. 923) for Cycle B individually designed

plans.

The changes required by the 2012 Cumulative List (Notice 2012-76, 2012-52 I.R.B. 775) for Cycle C individually designed

plans.

Amendments required as a condition for a favorable determination letter. If this item was selected answer the following

questions by checking the applicable boxes:

Is this the sole failure for the VCP submission?

Yes

No

Were the amendments signed within three months of the expiration of the remedial amendment period for adopting the

amendments?

Yes

No

14568-B

Catalog Number 66146J

Form

(1-2014)

For Paperwork Reduction Act information see Revenue Procedure 2013-12.

1

1 2

2