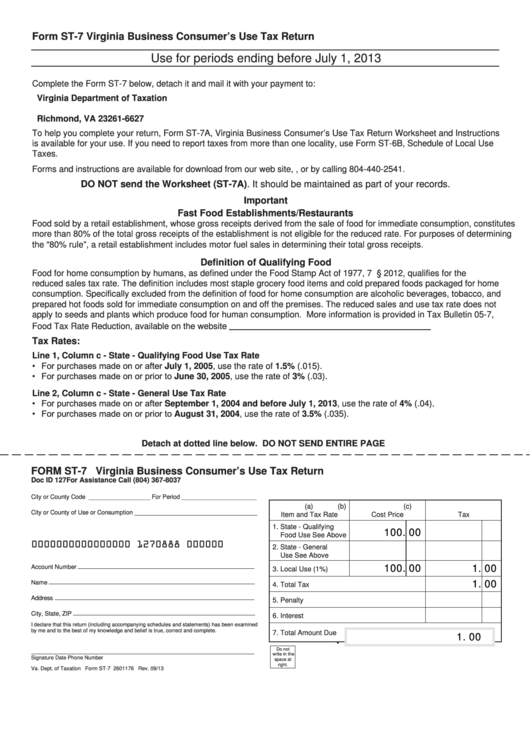

Form ST-7

Virginia Business Consumer’s Use Tax Return

Use for periods ending before July 1, 2013

Complete the Form ST-7 below, detach it and mail it with your payment to:

Virginia Department of Taxation

P.O. Box 26627

Richmond, VA 23261-6627

To help you complete your return, Form ST-7A, Virginia Business Consumer’s Use Tax Return Worksheet and Instructions

is available for your use. If you need to report taxes from more than one locality, use Form ST-6B, Schedule of Local Use

Taxes.

Forms and instructions are available for download from our web site, , or by calling 804-440-2541.

DO NOT send the Worksheet (ST-7A). It should be maintained as part of your records.

Important

Fast Food Establishments/Restaurants

Food sold by a retail establishment, whose gross receipts derived from the sale of food for immediate consumption, constitutes

more than 80% of the total gross receipts of the establishment is not eligible for the reduced rate. For purposes of determining

the “80% rule”, a retail establishment includes motor fuel sales in determining their total gross receipts.

Definition of Qualifying Food

Food for home consumption by humans, as defined under the Food Stamp Act of 1977, 7 U.S.C. § 2012, qualifies for the

reduced sales tax rate. The definition includes most staple grocery food items and cold prepared foods packaged for home

consumption. Specifically excluded from the definition of food for home consumption are alcoholic beverages, tobacco, and

prepared hot foods sold for immediate consumption on and off the premises. The reduced sales and use tax rate does not

apply to seeds and plants which produce food for human consumption. More information is provided in Tax Bulletin 05-7,

Food Tax Rate Reduction, available on the website

Tax Rates:

Line 1, Column c - State - Qualifying Food Use Tax Rate

• For purchases made on or after July 1, 2005, use the rate of 1.5% (.015).

• For purchases made on or prior to June 30, 2005, use the rate of 3% (.03).

Line 2, Column c - State - General Use Tax Rate

• For purchases made on or after September 1, 2004 and before July 1, 2013, use the rate of 4% (.04).

• For purchases made on or prior to August 31, 2004, use the rate of 3.5% (.035).

Detach at dotted line below. DO NOT SEND ENTIRE PAGE

FORM ST-7 Virginia Business Consumer’s Use Tax Return

Doc ID 127

For Assistance Call (804) 367-8037

City or County Code __________________ For Period ______________________

(a)

(b)

(c)

City or County of Use or Consumption ____________________________________

Item and Tax Rate

Cost Price

Tax

1. State - Qualifying

100.00

Food Use See Above

0000000000000000 1270888 000000

2. State - General

Use See Above

100.00

1.00

Account Number

3. Local Use (1%)

1.00

Name

4. Total Tax

Address

5. Penalty

City, State, ZIP

6. Interest

I declare that this return (including accompanying schedules and statements) has been examined

by me and to the best of my knowledge and belief is true, correct and complete.

7. Total Amount Due

1.00

.

Do not

write in the

Signature

Date

Phone Number

space at

right.

Va. Dept. of Taxation Form ST-7 2601176 Rev. 09/13

1

1 2

2 3

3 4

4