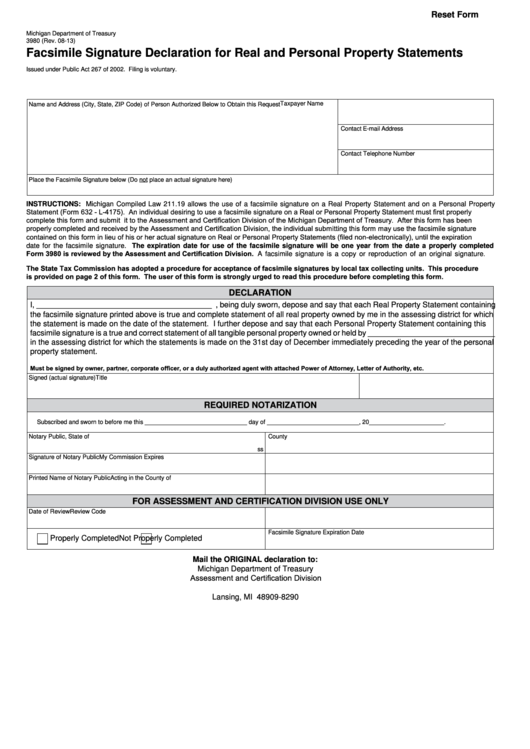

Reset Form

Michigan Department of Treasury

3980 (Rev. 08-13)

Facsimile Signature Declaration for Real and Personal Property Statements

Issued under Public Act 267 of 2002. Filing is voluntary.

Taxpayer Name

Name and Address (City, State, ZIP Code) of Person Authorized Below to Obtain this Request

Contact E-mail Address

Contact Telephone Number

Place the Facsimile Signature below (Do not place an actual signature here)

INSTRUCTIONS: Michigan Compiled Law 211.19 allows the use of a facsimile signature on a Real Property Statement and on a Personal Property

Statement (Form 632 - L-4175). An individual desiring to use a facsimile signature on a Real or Personal Property Statement must first properly

complete this form and submit it to the Assessment and Certification Division of the Michigan Department of Treasury. After this form has been

properly completed and received by the Assessment and Certification Division, the individual submitting this form may use the facsimile signature

contained on this form in lieu of his or her actual signature on Real or Personal Property Statements (filed non-electronically), until the expiration

date for the facsimile signature. The expiration date for use of the facsimile signature will be one year from the date a properly completed

Form 3980 is reviewed by the Assessment and Certification Division. A facsimile signature is a copy or reproduction of an original signature.

The State Tax Commission has adopted a procedure for acceptance of facsimile signatures by local tax collecting units. This procedure

is provided on page 2 of this form.

The user of this form is strongly urged to read this procedure before completing this form.

DECLARATION

I, ________________________________________ , being duly sworn, depose and say that each Real Property Statement containing

the facsimile signature printed above is true and complete statement of all real property owned by me in the assessing district for which

the statement is made on the date of the statement. I further depose and say that each Personal Property Statement containing this

facsimile signature is a true and correct statement of all tangible personal property owned or held by _____________________________

in the assessing district for which the statements is made on the 31st day of December immediately preceding the year of the personal

property statement.

Must be signed by owner, partner, corporate officer, or a duly authorized agent with attached Power of Attorney, Letter of Authority, etc.

Signed (actual signature)

Title

REQUIRED NOTARIZATION

Subscribed and sworn to before me this ______________________________ day of ___________________________, 20______________________.

Notary Public, State of

County

ss

Signature of Notary Public

My Commission Expires

Printed Name of Notary Public

Acting in the County of

FOR ASSESSMENT AND CERTIFICATION DIVISION USE ONLY

Date of Review

Review Code

Facsimile Signature Expiration Date

Properly Completed

Not Properly Completed

Mail the ORIGINAL declaration to:

Michigan Department of Treasury

Assessment and Certification Division

P.O. Box 30790

Lansing, MI 48909-8290

1

1 2

2