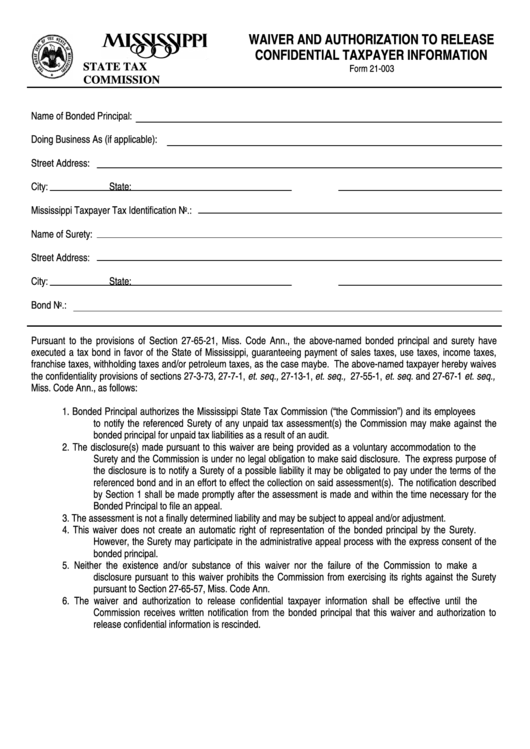

Form 21-003 - Waiver And Authorization To Release Confidential Taxpayer Information

ADVERTISEMENT

WAIVER AND AUTHORIZATION TO RELEASE

CONFIDENTIAL TAXPAYER INFORMATION

STATE TAX

Form 21-003

COMMISSION

Name of Bonded Principal:

Doing Business As (if applicable):

Street Address:

City:

State:

Mississippi Taxpayer Tax Identification No.:

Name of Surety:

Street Address:

City:

State:

Bond No.:

Pursuant to the provisions of Section 27-65-21, Miss. Code Ann., the above-named bonded principal and surety have

executed a tax bond in favor of the State of Mississippi, guaranteeing payment of sales taxes, use taxes, income taxes,

franchise taxes, withholding taxes and/or petroleum taxes, as the case maybe. The above-named taxpayer hereby waives

the confidentiality provisions of sections 27-3-73, 27-7-1, et. seq., 27-13-1, et. seq., 27-55-1, et. seq. and 27-67-1 et. seq.,

Miss. Code Ann., as follows:

1.

Bonded Principal authorizes the Mississippi State Tax Commission (“the Commission”) and its employees

to notify the referenced Surety of any unpaid tax assessment(s) the Commission may make against the

bonded principal for unpaid tax liabilities as a result of an audit.

2.

The disclosure(s) made pursuant to this waiver are being provided as a voluntary accommodation to the

Surety and the Commission is under no legal obligation to make said disclosure. The express purpose of

the disclosure is to notify a Surety of a possible liability it may be obligated to pay under the terms of the

referenced bond and in an effort to effect the collection on said assessment(s). The notification described

by Section 1 shall be made promptly after the assessment is made and within the time necessary for the

Bonded Principal to file an appeal.

3.

The assessment is not a finally determined liability and may be subject to appeal and/or adjustment.

4.

This waiver does not create an automatic right of representation of the bonded principal by the Surety.

However, the Surety may participate in the administrative appeal process with the express consent of the

bonded principal.

5.

Neither the existence and/or substance of this waiver nor the failure of the Commission to make a

disclosure pursuant to this waiver prohibits the Commission from exercising its rights against the Surety

pursuant to Section 27-65-57, Miss. Code Ann.

6.

The waiver and authorization to release confidential taxpayer information shall be effective until the

Commission receives written notification from the bonded principal that this waiver and authorization to

release confidential information is rescinded.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2