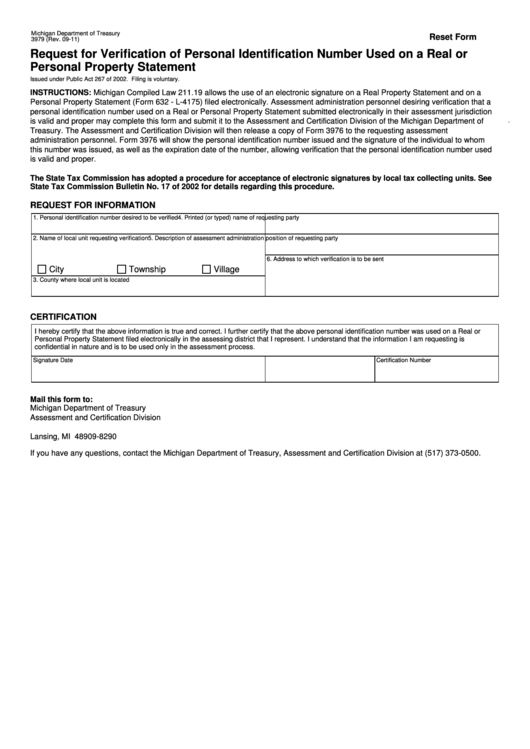

Michigan Department of Treasury

Reset Form

3979 (Rev. 09-11)

Request for Verification of Personal Identification Number Used on a Real or

Personal Property Statement

Issued under Public Act 267 of 2002. Filing is voluntary.

INSTRUCTIONS: Michigan Compiled Law 211.19 allows the use of an electronic signature on a Real Property Statement and on a

Personal Property Statement (Form 632 - L-4175) filed electronically. Assessment administration personnel desiring verification that a

personal identification number used on a Real or Personal Property Statement submitted electronically in their assessment jurisdiction

is valid and proper may complete this form and submit it to the Assessment and Certification Division of the Michigan Department of

.

Treasury. The Assessment and Certification Division will then release a copy of Form 3976 to the requesting assessment

administration personnel. Form 3976 will show the personal identification number issued and the signature of the individual to whom

this number was issued, as well as the expiration date of the number, allowing verification that the personal identification number used

is valid and proper.

The State Tax Commission has adopted a procedure for acceptance of electronic signatures by local tax collecting units. See

State Tax Commission Bulletin No. 17 of 2002 for details regarding this procedure.

REQUEST FOR INFORMATION

1. Personal identification number desired to be verified

4. Printed (or typed) name of requesting party

2. Name of local unit requesting verification

5. Description of assessment administration position of requesting party

6. Address to which verification is to be sent

City

Township

Village

3. County where local unit is located

CERTIFICATION

I hereby certify that the above information is true and correct. I further certify that the above personal identification number was used on a Real or

Personal Property Statement filed electronically in the assessing district that I represent. I understand that the information I am requesting is

confidential in nature and is to be used only in the assessment process.

Signature

Date

Certification Number

Mail this form to:

Michigan Department of Treasury

Assessment and Certification Division

P.O. Box 30790

Lansing, MI 48909-8290

If you have any questions, contact the Michigan Department of Treasury, Assessment and Certification Division at (517) 373-0500.

1

1