Form Hw-3 - Employer'S Annual Return And Reconciliation Of Hawaii Income Tax Withheld From Wages

ADVERTISEMENT

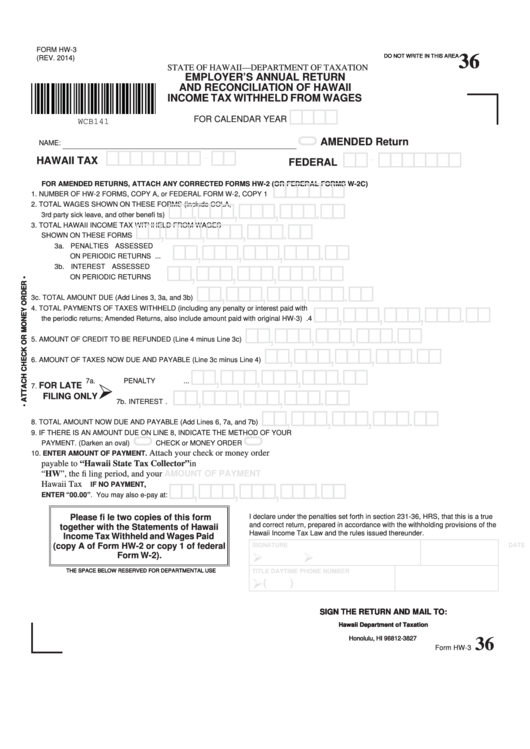

FORM HW-3

DO NOT WRITE IN THIS AREA

DO NOT WRITE IN THIS AREA

DO NOT WRITE IN THIS AREA

36

36

36

(REV. 2014)

STATE OF HAWAII—DEPARTMENT OF TAXATION

EMPLOYER’S ANNUAL RETURN

AND RECONCILIATION OF HAWAII

INCOME TAX WITHHELD FROM WAGES

!!!!

=

FOR CALENDAR YEAR

WCB141

AMENDED Return

NAME: ____________________________________________________________

!!!!!!!!-!!

!!-!!!!!!!

HAWAII TAX I.D. NO. W

FEDERAL I.D. NO.

!!!!!!

FOR AMENDED RETURNS, ATTACH ANY CORRECTED FORMS HW-2 (OR FEDERAL FORMS W-2C)

1. NUMBER OF HW-2 FORMS, COPY A, or FEDERAL FORM W-2, COPY 1 .................. 1

!!,!!!,!!!,!!!.!!

2. TOTAL WAGES SHOWN ON THESE FORMS (include COLA,

3rd party sick leave, and other benefi ts) .......................................................................... 2

!!,!!!,!!!,!!!.!!

3. TOTAL HAWAII INCOME TAX WITHHELD FROM WAGES

SHOWN ON THESE FORMS .......................................................................................... 3

!!,!!!,!!!,!!!.!!

3a. PENALTIES ASSESSED

ON PERIODIC RETURNS ...

!!,!!!,!!!,!!!.!!

3b. INTEREST ASSESSED

ON PERIODIC RETURNS ....

!!,!!!,!!!,!!!.!!

3c. TOTAL AMOUNT DUE (Add Lines 3, 3a, and 3b) .......................................................... 3c

!!,!!!,!!!,!!!.!!

4. TOTAL PAYMENTS OF TAXES WITHHELD (including any penalty or interest paid with

the periodic returns; Amended Returns, also include amount paid with original HW-3) . 4

!!,!!!,!!!,!!!.!!

5. AMOUNT OF CREDIT TO BE REFUNDED (Line 4 minus Line 3c) ................................ 5

!!,!!!,!!!,!!!.!!

6. AMOUNT OF TAXES NOW DUE AND PAYABLE (Line 3c minus Line 4) ........................ 6

!!,!!!,!!!,!!!.!!

7a. PENALTY ...

FOR LATE

7.

!!,!!!,!!!,!!!.!!

FILING ONLY

7b. INTEREST .

!!,!!!,!!!,!!!.!!

=

=

8. TOTAL AMOUNT NOW DUE AND PAYABLE (Add Lines 6, 7a, and 7b) ......................... 8

9. IF THERE IS AN AMOUNT DUE ON LINE 8, INDICATE THE METHOD OF YOUR

PAYMENT. (Darken an oval) ............................................................................................. 9

EFT

CHECK or MONEY ORDER

Attach your check or money order

10. ENTER AMOUNT OF PAYMENT.

payable to “Hawaii State Tax Collector” in U.S. dollars drawn on any

AMOUNT OF PAYMENT

U.S. bank to Form HW-3. Write “HW”, the fi ling period, and your

!!,!!!,!!!,!!!.!!

Hawaii Tax I.D. No. on your check or money order.

IF NO PAYMENT,

ENTER “00.00”. You may also e-pay at: tax.hawaii.gov/eservices/ ........................... 10

Please fi le two copies of this form

I declare under the penalties set forth in section 231-36, HRS, that this is a true

and correct return, prepared in accordance with the withholding provisions of the

together with the Statements of Hawaii

Hawaii Income Tax Law and the rules issued thereunder.

Income Tax Withheld and Wages Paid

(copy A of Form HW-2 or copy 1 of federal

SIGNATURE

DATE

Form W-2).

THE SPACE BELOW RESERVED FOR DEPARTMENTAL USE

THE SPACE BELOW RESERVED FOR DEPARTMENTAL USE

THE SPACE BELOW RESERVED FOR DEPARTMENTAL USE

TITLE

DAYTIME PHONE NUMBER

(

)

SIGN THE RETURN AND MAIL TO:

SIGN THE RETURN AND MAIL TO:

SIGN THE RETURN AND MAIL TO:

Hawaii Department of Taxation

Hawaii Department of Taxation

Hawaii Department of Taxation

P.O. Box 3827

P.O. Box 3827

P.O. Box 3827

Honolulu, HI 96812-3827

Honolulu, HI 96812-3827

Honolulu, HI 96812-3827

36

Form HW-3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1