Form Hw-4 - Employee'S Withholding Allowance And Status Certificate

ADVERTISEMENT

Clear Form

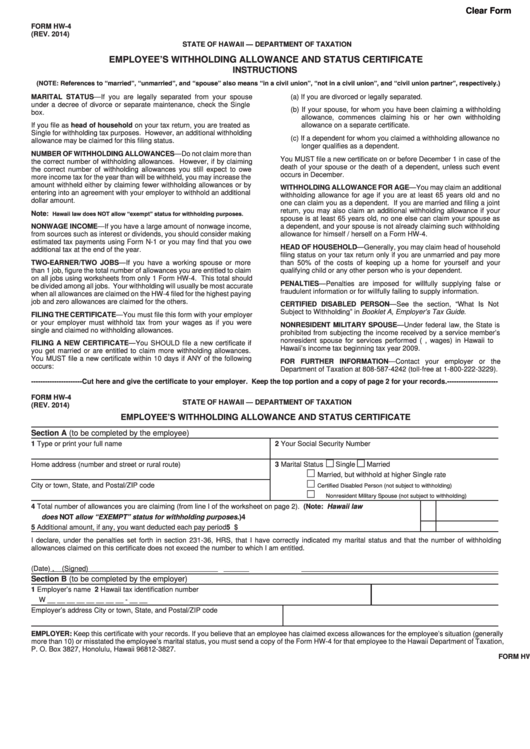

FORM HW-4

(REV. 2014)

STATE OF HAWAII — DEPARTMENT OF TAXATION

EMPLOYEE’S WITHHOLDING ALLOWANCE AND STATUS CERTIFICATE

INSTRUCTIONS

(NOTE: References to “married”, “unmarried”, and “spouse” also means “in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

MARITAL STATUS—If you are legally separated from your spouse

(a) If you are divorced or legally separated.

under a decree of divorce or separate maintenance, check the Single

(b) If your spouse, for whom you have been claiming a withholding

box.

allowance, commences claiming his or her own withholding

If you file as head of household on your tax return, you are treated as

allowance on a separate certificate.

Single for withholding tax purposes. However, an additional withholding

(c) If a dependent for whom you claimed a withholding allowance no

allowance may be claimed for this filing status.

longer qualifies as a dependent.

NUMBER OF WITHHOLDING ALLOWANCES—Do not claim more than

You MUST file a new certificate on or before December 1 in case of the

the correct number of withholding allowances. However, if by claiming

death of your spouse or the death of a dependent, unless such event

the correct number of withholding allowances you still expect to owe

occurs in December.

more income tax for the year than will be withheld, you may increase the

amount withheld either by claiming fewer withholding allowances or by

WITHHOLDING ALLOWANCE FOR AGE—You may claim an additional

entering into an agreement with your employer to withhold an additional

withholding allowance for age if you are at least 65 years old and no

dollar amount.

one can claim you as a dependent. If you are married and filing a joint

return, you may also claim an additional withholding allowance if your

Note: Hawaii law does NOT allow “exempt” status for withholding purposes.

spouse is at least 65 years old, no one else can claim your spouse as

NONWAGE INCOME—If you have a large amount of nonwage income,

a dependent, and your spouse is not already claiming such withholding

from sources such as interest or dividends, you should consider making

allowance for himself / herself on a Form HW-4.

estimated tax payments using Form N-1 or you may find that you owe

HEAD OF HOUSEHOLD—Generally, you may claim head of household

additional tax at the end of the year.

filing status on your tax return only if you are unmarried and pay more

TWO-EARNER/TWO JOBS—If you have a working spouse or more

than 50% of the costs of keeping up a home for yourself and your

than 1 job, figure the total number of allowances you are entitled to claim

qualifying child or any other person who is your dependent.

on all jobs using worksheets from only 1 Form HW-4. This total should

PENALTIES—Penalties are imposed for willfully supplying false or

be divided among all jobs. Your withholding will usually be most accurate

fraudulent information or for willfully failing to supply information.

when all allowances are claimed on the HW-4 filed for the highest paying

job and zero allowances are claimed for the others.

CERTIFIED DISABLED PERSON—See the section, “What Is Not

Subject to Withholding” in Booklet A, Employer’s Tax Guide.

FILING THE CERTIFICATE—You must file this form with your employer

or your employer must withhold tax from your wages as if you were

NONRESIDENT MILITARY SPOUSE—Under federal law, the State is

single and claimed no withholding allowances.

prohibited from subjecting the income received by a service member’s

nonresident spouse for services performed (i.e., wages) in Hawaii to

FILING A NEW CERTIFICATE—You SHOULD file a new certificate if

Hawaii’s income tax beginning tax year 2009.

you get married or are entitled to claim more withholding allowances.

You MUST file a new certificate within 10 days if ANY of the following

FOR FURTHER INFORMATION—Contact your employer or the

occurs:

Department of Taxation at 808-587-4242 (toll-free at 1-800-222-3229).

---------------------- Cut here and give the certificate to your employer. Keep the top portion and a copy of page 2 for your records. ----------------------

FORM HW-4

STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 2014)

EMPLOYEE’S WITHHOLDING ALLOWANCE AND STATUS CERTIFICATE

Section A (to be completed by the employee)

1 Type or print your full name

2 Your Social Security Number

Home address (number and street or rural route)

3 Marital Status

Single

Married

Married, but withhold at higher Single rate

Certified Disabled Person (not subject to withholding)

City or town, State, and Postal/ZIP code

Nonresident Military Spouse (not subject to withholding)

4 Total number of allowances you are claiming (from line I of the worksheet on page 2). (Note: Hawaii law

does NOT allow “EXEMPT” status for withholding purposes.) ..........................................................................................

4

5 Additional amount, if any, you want deducted each pay period ................................................................................................

5

$

I declare, under the penalties set forth in section 231-36, HRS, that I have correctly indicated my marital status and that the number of withholding

allowances claimed on this certificate does not exceed the number to which I am entitled.

(Date)

,

(Signed)

Section B (to be completed by the employer)

1 Employer’s name

2 Hawaii tax identification number

W __ __ __ __ __ __ __ __ - __ __

Employer’s address

City or town, State, and Postal/ZIP code

EMPLOYER: Keep this certificate with your records. If you believe that an employee has claimed excess allowances for the employee’s situation (generally

more than 10) or misstated the employee’s marital status, you must send a copy of the Form HW-4 for that employee to the Hawaii Department of Taxation,

P. O. Box 3827, Honolulu, Hawaii 96812-3827.

FORM HW-4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2