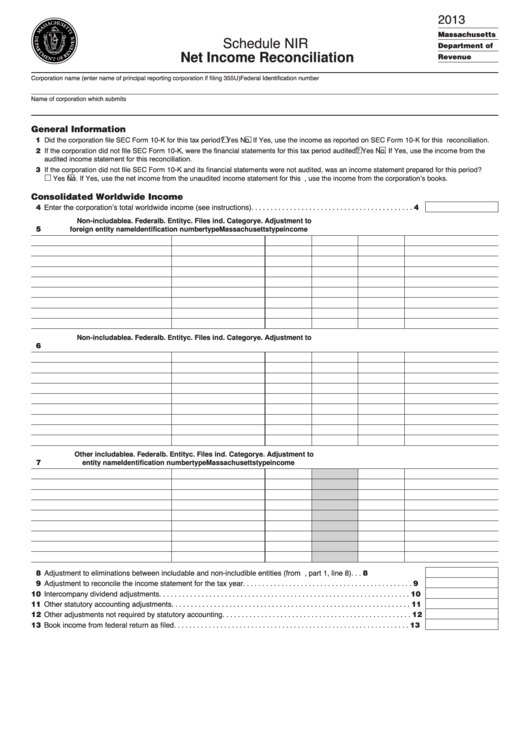

Schedule Nir - Net Income Reconciliation - 2013

ADVERTISEMENT

2013

Schedule NIR

Massachusetts

Department of

Net Income Reconciliation

Revenue

Corporation name (enter name of principal reporting corporation if filing 355U)

Federal Identification number

Name of corporation which submits U.S. Schedule M-3

Federal Identification number

General Information

11 Did the corporation file SEC Form 10-K for this tax period?

Yes

No. If Yes, use the income as reported on SEC Form 10-K for this reconciliation.

12 If the corporation did not file SEC Form 10-K, were the financial statements for this tax period audited?

Yes

No. If Yes, use the income from the

audited income statement for this reconciliation.

13 If the corporation did not file SEC Form 10-K and its financial statements were not audited, was an income statement prepared for this period?

Yes

No. If Yes, use the net income from the unaudited income statement for this reconciliation.If No, use the income from the corporation’s books.

Consolidated Worldwide Income

14 Enter the corporation’s total worldwide income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Non-includable

a. Federal

b. Entity

c. Files in

d. Category

e. Adjustment to

05

foreign entity name

Identification number

type

Massachusetts

type

income

Non-includable

a. Federal

b. Entity

c. Files in

d. Category

e. Adjustment to

06

U.S. entity name

Identification number

type

Massachusetts

type

income

Other includable

a. Federal

b. Entity

c. Files in

d. Category

e. Adjustment to

07

entity name

Identification number

type

Massachusetts

type

income

18 Adjustment to eliminations between includable and non-includible entities (from U.S. Schedule M-3, part 1, line 8). . . 8

19 Adjustment to reconcile the income statement for the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Intercompany dividend adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Other statutory accounting adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Other adjustments not required by statutory accounting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Book income from federal return as filed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3